Mark Pryce and Morag Watson of Azets outline the main tax targets for the upcoming Autumn statement expected this Thursday. The chancellor has made no secret of the fact that there are likely to be tax rises when he delivers the budget statement on Thursday, although he has also been quick to point

Tax

An HMRC investigation is underway into suspected fraudulent use of the research and development (R&D) tax relief scheme intended to promote investment into technology and innovation. So far, eight individuals have been arrested over their alleged misuse of government tax incentives. They al

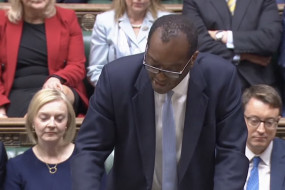

Today, Kwasi Kwarteng, the chancellor of the Exchequer revealed his fiscal plans in his emergency 'Mini Budget' aimed at boosting the economy to reach his 2.5% growth target. Mr Kwarteng's announced tax cuts and reforms, "the biggest package in generations", were met with mixed reactions.

The new UK government has ordered the treasury to audit existing and new anti-obesity policies which were to be introduced next month. The sugar tax, officially known as the Soft Drinks Industry Levy (SDIL), was introduced in 2018 as a measure to deter people from consuming unhealthy drinks high in

King Charles III has inherited a portfolio of assets worth tens of billions on which he will pay no inheritance tax. A law agreed in 1993 by John Major provides an inheritance tax exemption for any assets inherited from "sovereign to sovereign" as well as from any consort of a former sovereign. This

HMRC has been ordered to pay a disabled employee £20,000, following an employment tribunal ruling. Hamish Drummond, who suffers from unexplained bouts of dizziness and fainting, took his claim to the tribunal after his employer, HMRC, stopped him from submitting an application for a senio

The Treasury has collected a record £14.3 billion in capital gains tax (CGT) in the last financial year, an increase of 42% from the previous period. The record sum was realised on £80bn of gains. This is attributed to rushed sales of buy-to-let homes and growing house prices as an all-t

Not a single company has been prosecuted by HMRC under corporate tax evasion powers introduced five years ago. An offence for companies failing to stop those associated with the business from enabling tax evasion came into force in September 2017 under the Criminal Finances Act.

More than 33,600 customers have successfully used the HMRC app to renew their tax credits claim so far this year, a 39% increase on last year. HM Revenue and Customs (HMRC) is encouraging more customers to use the app, ahead of the 31st July deadline, as it is a quick and easy way to get

HM Revenue and Customs has fallen behind with myriad requests, accumulating a significant backlog of taxpayers' refunds, claims and penalty appeals. An analysis of HMRC's performance shows that targets are not being met in 14 out of 27 service categories, with long phoneline wait times and var

A Scottish think tank, Reform Scotland, has warned that Scotland's tax system requires a complete overhaul.

Just as the summer is about to begin in earnest, new VAT rules affecting UK suppliers selling goods and services online to EU consumers could dampen the mood for some businesses, writes Iain Masterton. The new EU VAT rules for B2C sales, being introduced on 1 July, come on the back of Brexit and are

Derek MacKay Finance Secretary Derek Mackay has promised the Scottish Government will be "progressive on taxation" as "more tax powers come on stream".

Carolyn Fairburn Edinburgh-based Standard Life has warned that the prospect of higher income tax, imposed by Holyrood, poses an increasing risk to its business.

Blair Stewart A single Edinburgh estate agent office sold 14 properties worth £330,000 or more over in just three weeks last month as well-off Scottish homebuyers raced to beat the deadline for the new property tax.