Self Assessment taxpayers have just one week left to pay their tax bill or set up a payment plan to avoid incurring a penalty, HMRC has urged. Customers have until 1 April to pay all tax due from their 2020/21 tax return and not receive a late payment penalty. If they are unable to pay in full, ther

Hmrc

AML Tax (UK) Limited, a firm owned by Scottish businessman Doug Barrowman, has been fined £150,000 for failing to provide HMRC with legally required information. The firm, which was part of Mr Barrowman's Isle of Man-based Knox Group, promoted tax avoidance schemes in the UK for years.

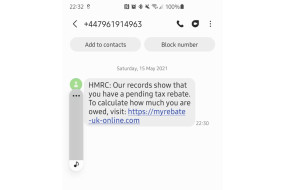

HMRC is warning Self Assessment customers to be on their guard following the Self Assessment deadline after more than 570,000 scams were reported to HMRC in the last year. At this time of year, Self Assessment customers are at increased risk of falling victim to scams, even if they don’t menti

HMRC has revealed that more than one million customers filed their late tax returns in February – taking advantage of the extra time to complete their Self Assessment without facing a penalty. About 12.2 million customers were expected to file a return for the 2020/21 tax year and more than 11

Adrian Chiles has won a seven-year battle with HMRC over a £1.7 million tax bill for his broadcasting work. A first-tier tax tribunal ruled that Chiles was right to organise his financial affairs through his company, Basic Broadcasting, and was not in effect an employee of the BBC and ITV.

HMRC has launched more than 20 criminal investigations involving crypto assets as it tries to defend itself against its rising crime levels encouraged by the unregulated market. The Daily Telegraph has reported that the tax authority is investigating a rising number of tax fraud and tax evasion case

Almost 100,000 Self Assessment customers have used online payment plans to spread the cost of their tax bill into manageable monthly instalments since April 2021, HMRC has revealed.

Scottish salmon exports recovered to near-record figures in 2021, according to new figures released by the UK Government.

More than 10.2 million customers filed their 2020/21 tax returns by the 31 January deadline, HMRC has revealed. More than 630,000 customers filed on deadline day and the peak hour for filing was 16:00 to 16:59 when 52,475 completed their Self Assessment. There were 20,947 customers who completed the

Four million customers are yet to submit their completed Self Assessment tax return and pay any tax owed ahead of the deadline on 31 January, HMR has warned. More than 12.2 million customers are expected to complete a tax return for the 2020/21 tax year.

Reports of scam HMRC phone calls have fallen by 97% over the last 12 months, according to the latest figures published by the tax authority.

HMRC is urging tax agents and accountants to remind their clients that COVID-19 support grants or payments are taxable and should be declared on their company tax returns. The deadline for customers or agents filing company tax returns (CT600) is 12 months after the end of the accounting period it c

HMRC is urging businesses to take steps to prepare for Making Tax Digital for Value Added Tax (VAT) before it becomes mandatory for all VAT-registered businesses from 1 April this year. Making Tax Digital is designed to help businesses eliminate common errors and save time managing their tax affairs

HMRC is waiving late filing and late payment penalties for Self Assessment taxpayers for one month, giving them extra time, if they need it, to complete their 2020/21 tax return and pay any tax due. HMRC is encouraging taxpayers to file and pay on time if they can, as the department reveals that, of

The liquidators of the Rangers Oldco have revealed that they are hoping to reduce the size of the tax liability owed to HMRC. BDO is disputing about £51 million of the £64.5m which is still being claimed by HMRC.