Wbg: Scottish businesses face ‘avalanche of costs’ from NIC hike

Craig Allison

Wbg has warned that budget changes are setting the stage for a harsh blow to employers, with implications that could shake the foundations of many industries.

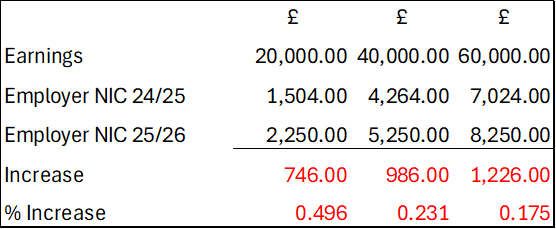

With the current Employer National Insurance Contributions (NIC) rate of 13.8% set to rise to 15% in April 2025, Craig Allison, associate director in Wbg’s insolvency team, said that while this 1.2% increase may sound modest, the impact is hidden in a drastic reduction of the NIC threshold – from £9,100 to a mere £5,000.

He explained: “This shift will unleash an avalanche of costs onto employers, especially for those whose workforce falls in lower income brackets.

“Consider the figures: companies will soon be paying a chilling 50% more each year in NICs for employees earning £20,000.

“This punishing increase will hit hardest in sectors where wages tend to be lower, like hospitality, an industry already crippled by the aftermath of COVID-19. Here, where average salaries are below the national mean, the costs will potentially skyrocket.”

NIC increase examples

To illustrate, Mr Allison cites an example of a hotel with 30 employees split across three salary bands. For two employees making £60,000 per annum, the NIC burden will climb by £2,452 annually. For three earning £40,000, the increase is £2,958. But the real shock comes with lower-income staff: 25 employees earning £20,000 will drive up the business’s NIC costs by a staggering £18,650.

“In total, this hotel will be faced with a hefty £24,060 increase – potentially enough to destabilise a business already on the verge of financial difficulty,” he said.

“Many industries are just starting to regain their footing post-pandemic, and these additional costs could mean the difference between survival and insolvency. Unfortunately, the more employees you have, the more impact these changes are likely to have.”