Scottish economic outlook looks set for weaker growth momentum

James Kergon – Senior partner at KPMG Scotland

Scotland is poised for a gradual economic recovery with steady growth predicted over the medium term, according to KPMG UK’s inaugural Scottish Economic Outlook report.

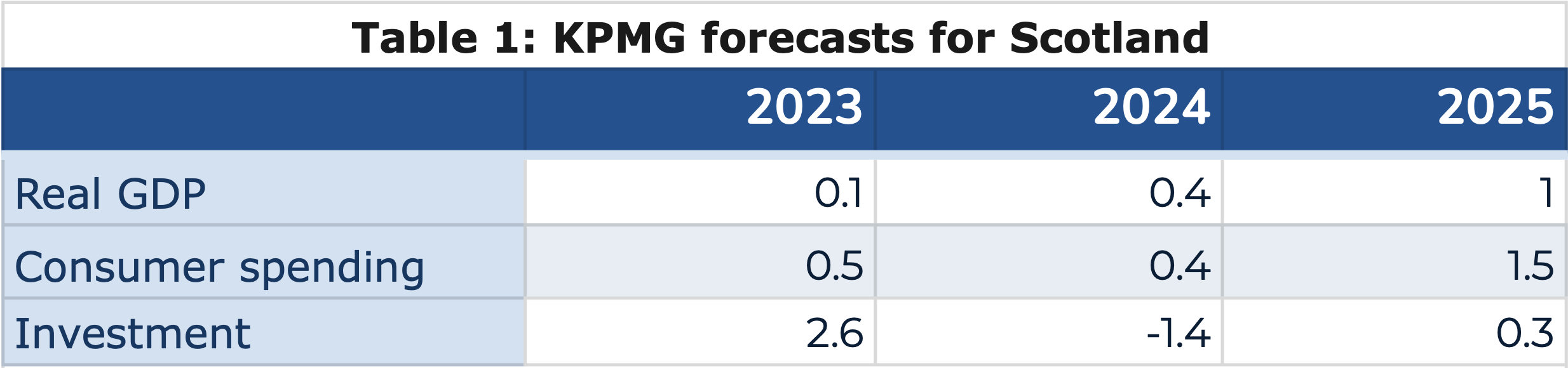

The forecast shows growth of 0.4% for the Scottish economy this year, similar to the rest of the UK, but relatively weak by historical standards, with that expected to pick up to 1% in 2025.

Risks to these numbers include potential supply chain disruptions, particularly for the manufacturing sector, but, on the upside, looser financial conditions could see a pickup in business investment and potentially stronger productivity leading to higher economic growth.

Average % change on previous calendar year. Investment represents Gross Fixed Capital Formation. (Source: The Scottish Government, KPMG forecasts.)

Unlike the rest of the UK, the Scottish economy managed to avoid a technical recession in 2023, posting growth of 0.1% for the year. As a result, GDP at the end of 2023 was just 1% above its pre-Covid level, broadly matching the UK performance.

More recent momentum – based on regional Purchasing Managers’ Surveys (PMIs) – suggests a pickup in activity at the start of 2024, with March marking the third consecutive month of private sector expansion. Business confidence remains in line with the UK average, consistent with cautious optimism about the year ahead.

The labour market has remained robust, with the unemployment rate averaging 4% over 2023.

Against this backdrop, we expect consumer spending to grow at 0.4% in 2024 and accelerate to 1.5% in 2025.

The outlook for consumer spending rests on three key developments:

- Expected moderation in inflation supports real households’ disposable income and a recovery in purchasing power

- Ongoing improvement in consumer confidence seen since the start of 2023 keeps the saving ratio low, as households feel more secure to spend

- Low relative housing costs, as Scotland boasts the lowest house price-to-earnings ratio in the UK, and is the only region alongside London where affordability has improved since 2019, allowing a larger share of income to be spent on other goods and services.

Business investment has been hurt by higher interest rates, along with earlier global supply chain disruptions. The report expects the weaker investment momentum to persist, resulting in a 1.4% fall in investment in 2024, with a modest return to growth next year as near-term uncertainties ease.

The gradual decline of the Scottish oil and gas industry adds further complexity. Declining opportunities for extraction have made investment in the UK Continental Shelf less attractive, which in turn directs less demand towards the onshore economy via the related supply chains.

Other long-term challenges relate to the economy’s productive capacity. The latest ONS population projections imply a slowing rate of population growth, with outright falls from the early-2030s. This is compounded by the effects of population ageing, which are expected to lead to a further decline in the labour force.

Yael Selfin – Chief economist at KPMG UK

Yael Selfin, chief economist at KPMG UK, said: “While our forecast shows weaker growth momentum compared with the pre-Covid decade, there are nonetheless some reasons for optimism.

“We expect consumer demand to remain relatively solid, while the adoption of new technologies could boost productivity growth in the medium term.”

James Kergon, senior partner at KPMG Scotland, added: “Businesses in Scotland will have to adjust to the long-term challenges facing the economy, including slowing population growth and a secular decline in the oil and gas activity.

“Those able to turn this into opportunity will stand ready to reap advantages of the energy transition, while the productivity gap with the rest of the UK offers scope for catch-up growth.”

Ms Selfin concluded: The big question mark remains around the outlook for investment, which is forecast to fall for the first time since the Covid pandemic.

“However, with many projects currently put on hold, the question is hopefully when – and not if – businesses will resume capital expenditures.

“The expected fall in interest rates could provide a much-needed boost, although the near-term outlook for monetary policy is somewhat less clear than at the start of the year.”