Scotland is fifth most risk-averse region when it comes to saving and investing

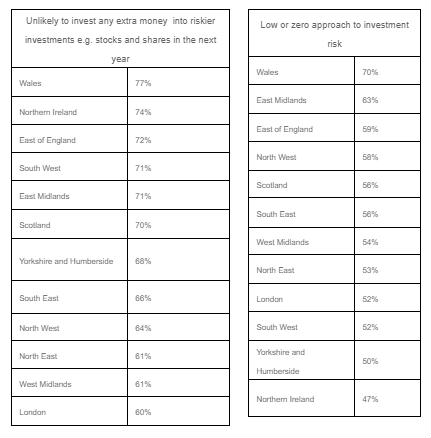

Scotland ranks in fifth place out of all UK local authority areas with 56 per cent admitting that when it comes to taking risk with their savings and investments they have a low or zero attitude.

The finding was revealed via new research by Edinburgh-based savings and investments company, Aegon UK, which highlights the investment appetite of consumers, revealing that overall, British people are risk-averse, with over half (56 per cent) of those surveyed across the country admitting that their risk appetite is low or zero, preferring lower returns for minimal potential loss.

Reaffirming this, when it comes to putting money into riskier investments such as stocks and shares, 70 per cent in the East Midlands said they would be unlikely to invest any extra money into these strategies, compared to a UK average of 67 per cent.

Nick Dixon, investment director at Aegon said: “Regardless of the current turbulent political and investment landscape, failing to take measured risk is not prudent. Over the long term, reckless caution is the biggest risk of all. Our research shows that the majority of UK consumers are exposing their money to stagnation and putting their assets at risk of falling well below the rate of inflation. This highlights the great value of good financial advice, which can build savers’ confidence and improve their understanding of risk to inform the right long-term investment decisions. With careful analysis, both adviser portfolios and multi-asset funds can be constructed to meet specific risk and return objectives.”