Savills: Property lenders and investors favour living sectors and logistics

Lender and investor sentiment has improved compared to 12 months ago, Savills revealed at its 36th Financing Property presentation.

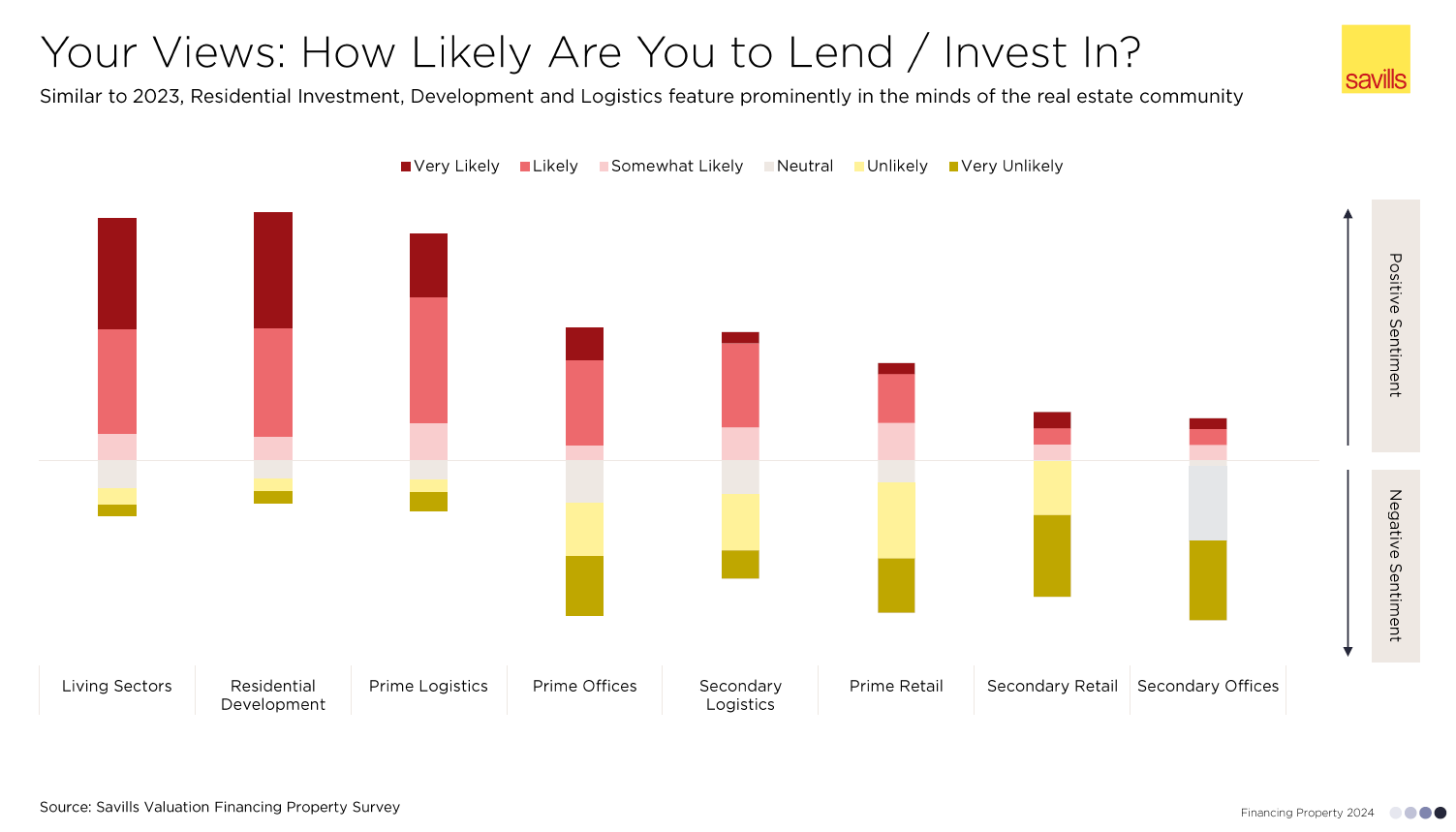

According to Savills’ survey, respondents particularly favoured in the living sectors, residential development and prime logistics.

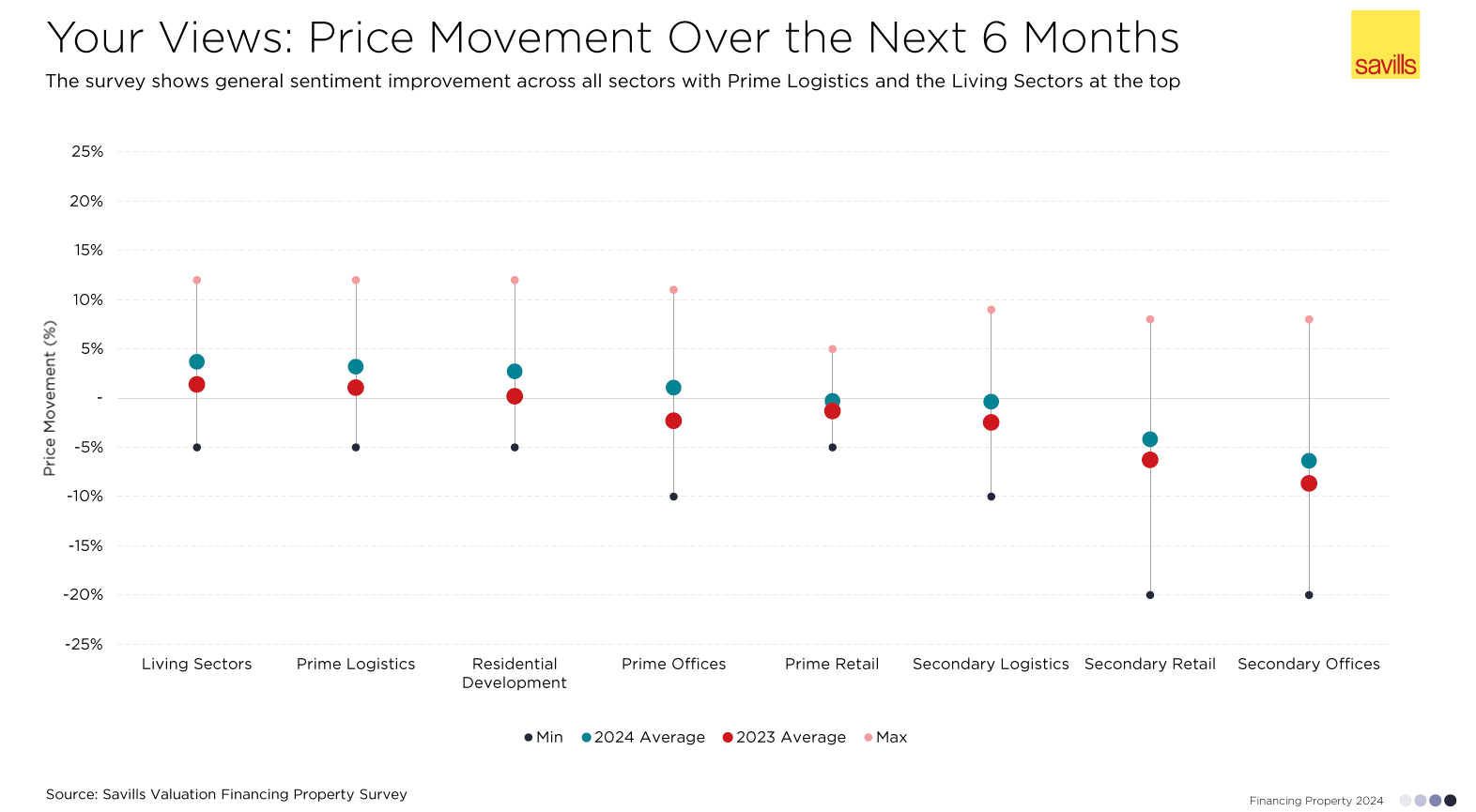

Sentiment around pricing also improved across all property sectors compared to last year.

Craig Timney, Savills head of UK valuation operations & head of Edinburgh office, said: “Positive sentiment is returning, with the living sectors, residential development and prime logistics most favoured by the lender and investor community.

“It is interesting to note the divergence of views on where the markets are heading has tightened across most asset classes, suggesting greater comfort has been reached on price discovery.”

Savills observes that 2023 ended with around £40 billion of assets traded, down significantly on historic levels. And, despite the early optimism for the market in 2024, the transactional data from the first quarter of 2024 represented a Q1 12-year low. However, there have been some high profile transactions concluded and there is an expectation that volumes will improve as the year progresses and the recovery takes hold.

Unsurprisingly, given the low transactional levels, new loan originations were at their lowest level since 2012 with the recent Bayes CRE Lending Report suggesting only around £32.6bn was originated, down a third on 2022. Much of the activity was focused on refinancing with many lenders increasingly working with their borrowers to restructure loans.

Craig Timney

Mr Timney continued: “We have seen some forbearance from lenders but clearly at some stage, these historic loan positions need to be addressed. Many lenders have told us that they expect substantially more activity in this space over the next 12 months.

“Of course, with higher borrowing costs and declining values in many sub-sectors, when investors come to refinance or restructure a loan, there is a risk that there will be a gap between the level of debt required, and the amount of debt lenders are willing to offer and this raises a question over how the funding gap will unravel over the next few years.”

Addressing the commercial property market, Mat Oakley, head of commercial research at Savills, highlighted that while UK investment volumes have recovered from its low in Q3 2023 and prime yields have started to harden, investment activity is still being held back by both expectations of recovery and the hunt for distress.

He commented: “The post great financial crisis period suggests the peak in distressed sales will come in the next couple of years. Some sectors will recover quicker when interest rates come down especially in sectors where there is conviction or mispricing and we’re already starting to see yields harden for retail warehouses, industrial and hotels.

“When it comes to offices, there are definitely challenges for demand but these have been largely overstated particularly when you take into consideration employment growth and density reduction.

“Prime Scottish office rents are expected to continue to rise steadily over the next few years, outpacing some of their regional rivals. Some investors are clearly wise to this, and are already targeting Scottish offices for their high yields and solid rental growth prospects.”

On pricing, Savills notes the market is still exercising caution until trading volumes are normalised but believes pricing is close to, or at the bottom for many prime sectors in the UK. Overall, pricing is currently around 25% down from June 2022, albeit this varies significantly across sub sectors.

Faisal Choudhry

Looking at the residential sector, Faisal Choudhry, head of the Savills Scottish residential research team, said: “The UK housing sector has been performing more strongly than many had anticipated this year, with Scotland outperforming the market. Market strength has been supported by an improvement in mortgage rates and buyer confidence.

“The number of Scottish second hand net agreed sales during the first five months of 2024 was 9% higher compared to the same period in 2023, according to data provider TwentyCi.

“There has been a reversal of pandemic trends with commuter locations performing more strongly than rural and lifestyle locations.”

Meanwhile, Scottish house prices rose year-on-year by 3.7% during Q1 2024, compared to 1.0% across the UK. With buyers taking out longer mortgage terms, prices were supported by more cash buyers and strong wage growth. However, an increase in the number of unsold homes has restricted price growth as properties are taking longer to sell compared to the pandemic years.

Looking forward, an improving economic outlook and further anticipated interest rate cuts are likely to create more capacity for house price growth.

Rental prices in Scotland’s main cities continue to rise however the rate of growth has slowed as tenant affordability has come under pressure. Across the UK, there was £4.5bn invested into the Build to Rent sector in 2023, the second highest on record.

However, investment in Scotland’s nascent Build to Rent sector has ground to a halt, mainly due to a lack of clarity around the Scottish Government’s proposed rental controls.