Revenues top $2.2 billion in Revolut’s third profitable year

Revolut co-founders CTO Vlad Yatsenko and CEO Nikolay Storonsky

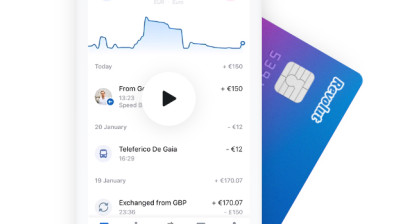

Revolut has posted a 95% surge in revenues to $2.2 billion (around £1.74bn), and a record profit before tax of $545 million (around £430m), marking the fintech’s third consecutive year of profitability.

The company attributed its success to a focus on core banking services in Europe, strategic reinvestment in product development, and expansion into new markets. Revolut also introduced local features like IBANs and credit products in various European countries.

The business added 12 million new customers in 2023, reaching a total of 38 million, and this figure has already climbed to 45 million by June 2024.

Looking ahead, Revolut is on track to surpass 50 million customers by the end of 2024. The company is also expanding its product offerings with innovations like eSIMs, RevPoints, and a robo-advisor. Additionally, Revolut has announced its new global headquarters in Canary Wharf, London, to accommodate its expanding operations.

Nik Storonsky, CEO of Revolut, said: “This year, we took our biggest steps yet on our mission to deliver the best product and the best customer experience at great value to customers, everywhere.

“Our customer base is expanding at impressive rates, and our diversified business model continues to fuel exceptional financial performance, delivering revenues of over $2.2bn in 2023 and a record profit before tax of $545m. With a net profit of $428m, 2023 was our third profitable year in a row.”

He concluded: “We remain committed to our ongoing UK banking licence application in addition to bringing the Revolut app to new markets and customers around the world.

“Even as we reached 45 million global retail customers six months into 2024, Revolut remains poised for exponential growth in 2024 and beyond, continuing to redefine the financial services landscape as we’ve known it.”