RBS: Scottish private sector sees decline in business activity and new orders

Judith Cruickshank

The Royal Bank of Scotland’s latest PMI survey recorded almost no change in business activity across Scotland’s private sector for August 2023.

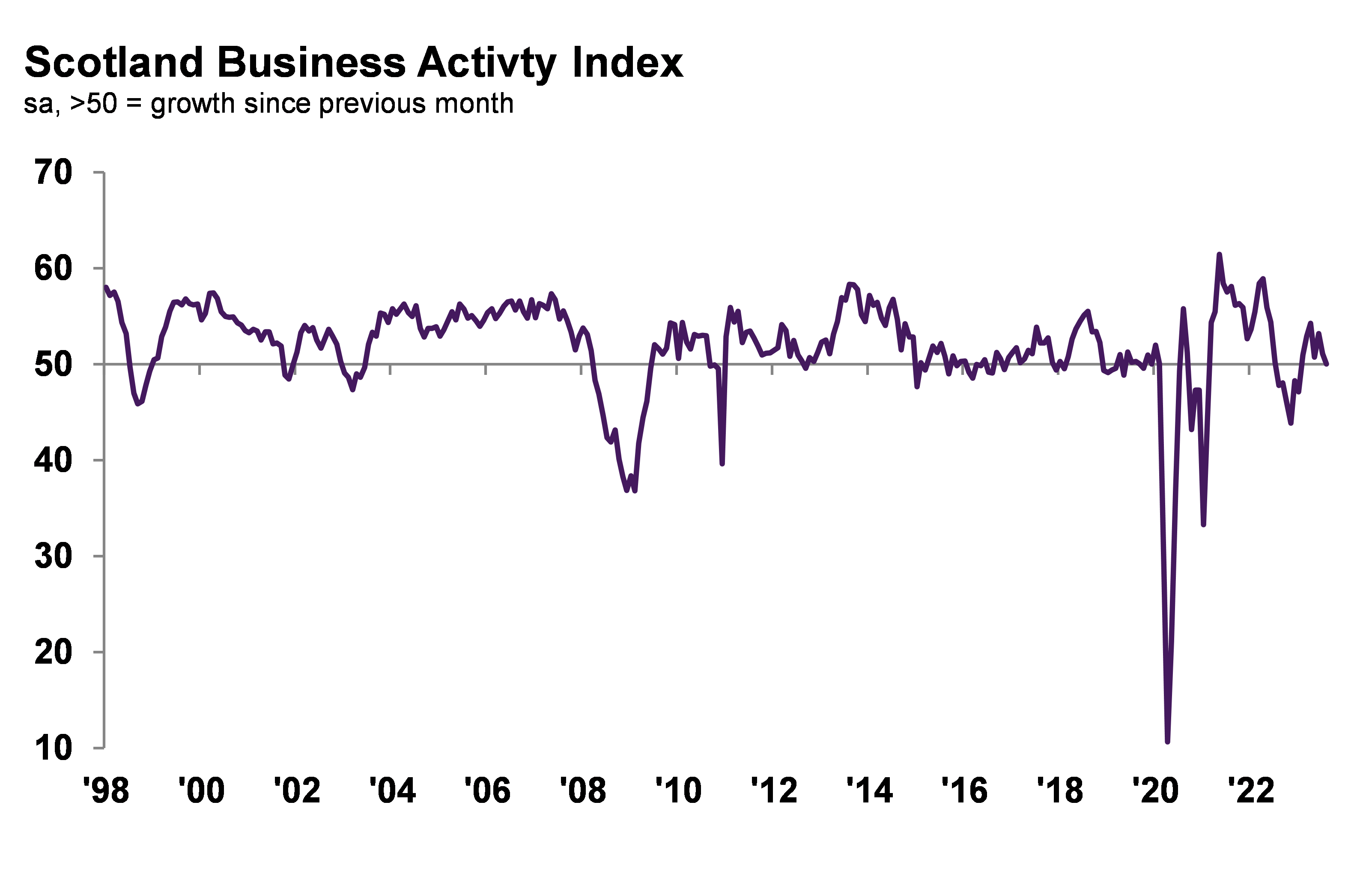

The Scotland Business Activity Index slipped from 51.1 in July to an exact 50.0, ending six months of growth. In addition to this, new orders across both the service and manufacturing sectors experienced their second consecutive month of decline, driven by economic uncertainties, inflation, and rising living costs.

Meanwhile, private sector companies still registered historically sharp increases in their cost burdens; as a result, charges for goods and services were also raised sharply. Business confidence slipped to an eight-month low.

Following the broad stagnation in new business across Scottish private sector firms in July, August data revealed a modest contraction. Service providers posted the first decline in seven months, while manufacturing new orders fell for the fifth month running and at a marked pace. According to anecdotal evidence, the latest fall in new business was attributed to inflation, economic uncertainty and the cost of living all having pressed demand.

The rate of reduction in new orders across Scotland was largely in line with that recorded at the UK level.

Private sector firms across Scotland continued to predict growth in activity in the coming 12 months during August. Hopes of improved demand conditions and customer growth, as well as increased marketing fed into greater expectations. However, the degree of confidence ticked down to an eight-month low in August as the current economic climate, inflation and scarcity of suitable candidates resulted to historically subdued confidence levels.

Scottish firms held the third-weakest outlook in the UK, ahead of the North East and Northern Ireland.

Source: Royal Bank of Scotland, S&P Global PMl.

Despite the drop in business requirements, August data revealed a seventh monthly expansion in employment across Scotland. The rate of job creation quickened after easing to a six-month low in July, suggesting that firms remained keen to bulk up their workforce numbers.

The rate of expansion in payroll numbers across Scotland was stronger than the UK-wide average.

August’s survey signalled a fourth successive monthly decrease in backlogs of work across Scotland’s private sector. A number of surveyed firms commented that reduced workload allowed firms to clear backlogs. Though the rate of backlog depletion was the fastest in three-months, it was weaker than the series average and the slowest of the 12 monitored UK areas.

Cost burdens continued to rise across Scotland midway through the third quarter. While the upward pressure on input costs has moderated considerably since the highs seen in the previous two years, the rate of growth remained historically strong largely due to the stickiness of prices across the service sector. Wages, suppliers, materials and fuel were all cited as reasons for the latest bout of inflation.

Cost inflation across Scotland was broadly in line with the UK average.

Charges were raised sharply across Scottish private sector firms in August, thereby stretching the current run of inflation to 34 months. Firms raised their charges in efforts to pass on their costs. That said, the pace of inflation softened from July, to signal the weakest increase in nearly two-and-a-half years and one that was broadly in line with the UK trend.

Judith Cruickshank, chair of RBS’ Scotland board, commented: “The latest PMI data for Scotland pointed to emerging weakness in the Scottish private sector, with firms signalling no change in private sector output and new orders contracting modestly amid reports of economic uncertainty and falling demand.

“Declining business requirements could result in a reduction in output unless the demand picture improves.

“Moreover, higher material, labour and energy costs meant that firms continued to struggle with rising cost burdens. In turn, companies raised their charges for the provision of goods and services.

“Lastly, business confidence around the year-ahead outlook remained historically subdued and weakened to an eight-month low, as frail demand conditions, higher interest rates and inflation all weighed on expectations.”