MSPs call for significant changes to debt solution

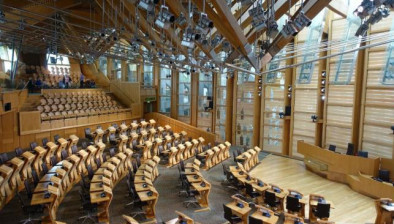

The Scottish Parliament’s Economy, Energy and Fair Work Committee has today published a report on protected trust deeds citing that changes are needed to make the debt solution more effective in supporting people who are in debt.

A protected trust deed is one of three statutory debt solutions in Scotland. It involves a debtor’s assets being managed by an insolvency practitioner for the benefit of the creditors for a four-year period. During this time, part of the debtor’s income is paid to the insolvency practitioner.

Last year around 8,000 people entered a protected trust deed, 150,000 people sought debt advice and, beyond that 600,000 adults are considered to be over-indebted in Scotland.

Amongst its calls within the report, the Committee asked for changes to the way fees are charged in protected trust deeds. The current rules can see debtors making contributions but not reducing their overall debt levels for at least the first two years.

Michelle Ballantyne MSP, Committee Convener, said: “Now more than ever people’s finances will be feeling the strain, and some will be contemplating seeking help to clear their debts. A debt solution should work in reducing that person’s debt. We heard evidence which showed that fees were being frontloaded resulting in the overall debt not lowering despite payments being made. This needs to change.

“The Committee welcomes the Scottish Government’s commitment to conduct an overarching debt review. However, it is incredibly important that the Scottish Government listen to the Committee’s recommendations to ensure that protected trust deeds act as an effective debt solution and debtors are safeguarded from the potential harm that can be caused when things go wrong.”

The Committee also heard evidence that online advertising and social media campaigns can target people in debt, offering a solution which is not always suitable for their circumstances.

Michelle Ballantyne MSP added: “People in debt must receive the right help and advice and not choose a solution based purely on what they saw on social media that day. The Committee recommends tighter regulations on online advertising and believes that free independent money advice would help ensure that people make the decision right for them.”

- Read all of our articles relating to COVID-19 here.