Medical Incubator Japan targets further UK healthcare investments in 2021

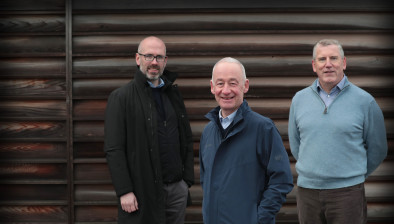

Jun Katsura

Medical Incubator Japan (MIJ), an independent venture capital fund investing in early-stage life sciences companies, is planning further UK healthcare investments in 2021 after completing two landmark UK investments in 2020.

MIJ’s first investment was in Lanarkshire-based ILC Therapeutics, which is developing treatments for immune diseases, cancer and other viral diseases such as COVID-19 through their work with synthetic interferons.

This funding round completed in November 2020 and was followed by MIJ’s investment in Blueberry Therapeutics, a dermatology drug discovery and development company focused on innovative nanomedicines for difficult to treat diseases of the skin and nail. MIJ invested in Blueberry’s Series B extension which completed in January 2021.

MIJ invests across a broad range of innovations including drug discovery, digital health and medical devices.

In partnership with Bamburgh Capital, MIJ is particularly focused on identifying opportunities in the UK, where MIJ is attracted by the breadth of innovative companies opening up world-class science and supported by collaborative, informed and influential ecosystems. Japan is the third-largest healthcare market in the world and MIJ will be able to help investee companies access and understand this important market.

Jun Katsura, MIJ president, said: “We are delighted to have made our first investments in the UK, and look forward to supporting ILC Therapeutics and Blueberry Therapeutics in realising the potential of their ground-breaking work in difficult to treat diseases. We are conviction investors in the UK, which we see as a stand-out investment market in global biotech and healthcare.

“This conviction is profoundly demonstrated by the high calibre of business leadership and ecosystem partners we meet and we have great optimism for the potential of this community in the UK to translate its world class innovation into commercial success. We would like to thank all those we have met with for their time in helping us to understand the important work they are doing and look forward to working with the team at Bamburgh to identify the next investments for MIJ.”

Alex Clarkson, director of Bamburgh Capital, added: “We have worked hard with MIJ to build their investment pipeline in the UK and would like to thank all the companies who have so far met MIJ.

“The quality of UK science combined with entrepreneurship means the UK is rightly identified as a clear priority for MIJ and they have quickly established themselves as a trusted partner in the UK life sciences community through their deep understanding of the science, straightforward investment approach and the depth of their commercial expertise.”