Martin Bell: What will Thursday mean for Scottish taxpayers?

Martin Bell

Martin Bell of BDO looks at what the Scottish Budget might have in store.

After a rollercoaster few months of fiscal statements, businesses and individuals will be looking closely at what’s to come in the Scottish Budget this week.

Overall, business leaders are looking for simplification and clarity. A roadmap so they can plan for the long-term. One area which is bound to generate interest is what the Scottish Government decides to do about income tax.

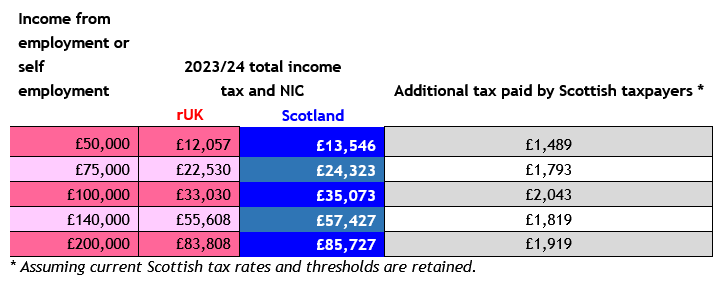

Currently and ignoring potential future tax changes in Scotland, Scottish taxpayers will be better off from 6 April 2023 as everyone will pay less National Insurance. The table below illustrates how the current differential between Scottish and rUK taxpayers would also narrow for higher earners as the starting point for the rUK additional rate band will reduce from £150,000 to £125,140 from 6 April 2023.

So, although an unlikely scenario, if all Scottish rates and bands were frozen for 2023/24, Scottish tax payers would find themselves better off year-on-year.

But there are more likely to be changes to the higher rates and bands given the Scottish Government comment last week that those with the “broadest shoulders” will be required to contribute more.

A reduction in the starting point for the 46% Scottish income tax to the rUK figure of £125,140 is almost certain and the Scottish Government may go further. Reducing that figure to £100,000 would mean that a Scottish taxpayer with employment or self-employment income of £140,000 would pay over £3,800 more tax compared to rUK.

- Martin Bell is a partner and head of tax at BDO in Scotland.