Knight Frank: Falling interest rates boost Scottish property investment

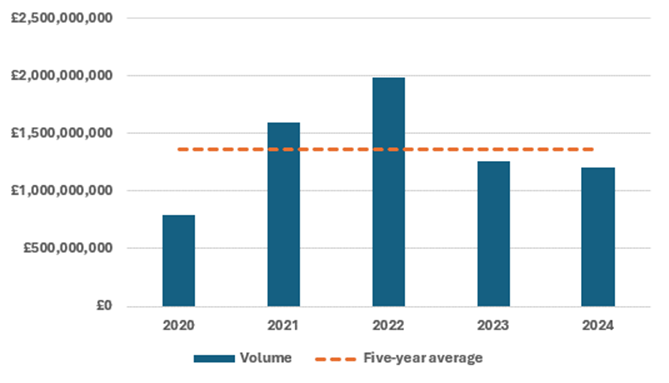

Investment in Scottish commercial property increased in the third quarter of 2024, as interest rates began to fall and a decisive election result provided more certainty over future policy direction, reaching £1.21 billion in the first nine months of the year, according to Knight Frank.

The commercial property consultancy’s analysis of Real Capital Analytics (RCA) data found that while the figure is marginally down on the £1.26bn recorded during the same period a year ago, it is a significant improvement on the 19% year-on-year gap seen during the first half of 2024.

Figure 1: Investment volumes Q1-Q3 2020-2024 – (source: RCA/Knight Frank)

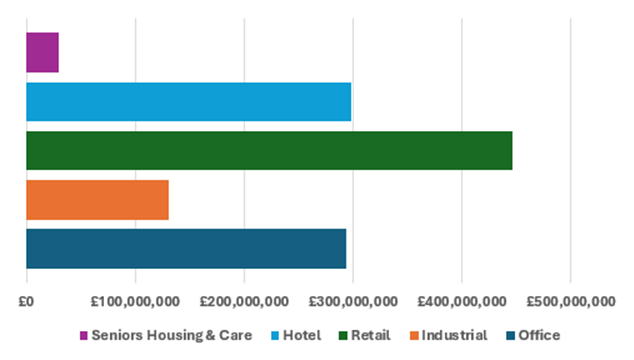

Investment in hotels rose to a five-year high for the first three quarters, reaching £298 million. It was the only time in the last five years that the sector was the second most active asset type, with only the retail sector ahead at £446m.

Figure 2: Investment volumes Q1-Q3 2024, by asset type – (source: RCA/Knight Frank)

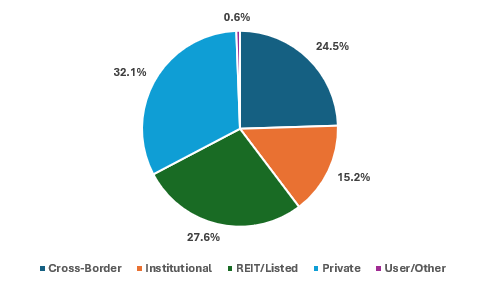

In a further departure from recent years, overseas investors’ share of investment volumes nearly halved to 24.5%, compared to 46.0% a year ago. Private investors were the most active buyers at 32.1% of overall investment, while real estate investment trusts (REITs) and listed property companies represented 27.6%.

Figure 2: Investment volumes Q1-Q3 2024, by buyer group – (source: RCA/Knight Frank)

However, at the tail end of the third quarter several deals approaching conclusions suggested international investors were returning to the Scottish market. These included Swedish firm Pandox AB acquiring the DoubleTree by Hilton in Edinburgh city centre, US investor Realty Income buying Airdrie’s Tesco superstore, and a Middle Eastern client of Citi purchasing a Glasgow office block at 220 High Street.

Alasdair Steele

Alasdair Steele, head of Scotland commercial at Knight Frank, said: “The cautious optimism that emerged in the first half of the year continued into the typically slower summer months, with a number of deals concluding and international buyers becoming more active once again.

“Their return, combined with reforms to local government pension fund pooling, should only lead to more interest from different sets of investors in Scottish commercial property.

“A combination of interest rates heading on a downward trajectory, greater certainty over policy direction following July’s election, and a more settled macroeconomic backdrop are helping to bring buyer and seller expectations closer together. There has been a flurry of transactions in the last month and, with others progressing, the final quarter of 2024 could be a relatively busy period.”

He continued: “Scotland’s growing attraction as a tourist destination is underpinning investment in hotels – particularly in Edinburgh – and retail’s recovery has continued, with the sale of Aberdeen’s Union Square earlier in the year and current interest in St James Quarter votes of confidence in the sector.

“Offices may not have attracted the same volumes in the last couple of years as they did prior to the pandemic, but there is good reason to believe that will change if and when the right stock becomes available, particularly given the sale of some recent prime assets.”