Kelvin Capital bolsters advisory board with international experts

Stuart McKee

Kelvin Capital, the investment firm specialising in early-stage disruptive technologies, has appointed a new senior advisory board with high level, international experience.

The Glasgow-based firm’s new advisory board will be chaired by Colin Robertson CBE, formerly chief executive of Alexander Dennis Limited and now chair and founder of Robertson Campbell Investments. He also holds numerous other executive and non-executive chair roles. Joining him are Simon Russell and John Thomson.

Mr Russell was formerly global technology partner and managing director with various investment banks including Nomura, Macquarie and PwC. He now leads his own consultancy practice and sits on numerous boards in a chair and non-executive capacity.

Formerly based in Singapore, Mr Thomson was a partner at 3i Asia for many years and brings vast direct investing insights alongside an outstanding network across Asia.

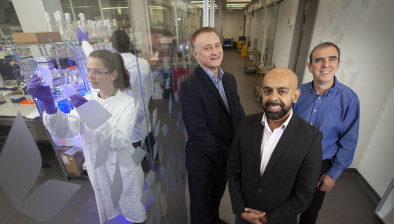

Also sitting on the new advisory board will be Stuart McKee, chair at Kelvin Capital. He was formerly global head of corporate finance at PwC and now sits on a number of boards and advisory boards across a variety of sectors.

Mr McKee said: “Colin, Simon and John bring many years of senior level experience working in global markets and across many sectors.

“As part of our planned programme of developments to provide greater support to existing and prospective investee companies their combined expertise across operational excellence, deep sector insight, supply chain management and accessing funding, acquisition targets and exit routes through personal geographically diverse networks will be a significant next step in the Kelvin Capital story.”

Mr Robertson said: “Kelvin Capital has already built a solid reputation for investing in disruptive or pioneering technologies with global ambitions so I’m delighted to be appointed to chair its advisory board, with Simon and John, to support existing portfolio companies, and to assist future investments too.”

The announcement of the new Advisory Board comes soon after Kelvin Capital announced that it had closed a record investment activity in the first six months of 2023 with £7.8 million, being secured for five portfolio companies, 22% higher than the same period in 2022.