ISA investors in UK stocks could have made £162,349 return over last 20 years - Willis Owen

An investor who used all their ISA allowance to invest in the UK stock market through a tracker over the last two decades could have made £162,349 after charges, according to analysis conducted by Willis Owen, the online investment service provider, to mark the 20th anniversary of the tax-free savings wrapper.

The analysis shows that if an investor had saved their full tax-free allowance of £206,560 [on the first day of each tax year] in a UK tracker such as the Scottish Widows UK All Share Tracker then they would now have a nest egg of £368,909.

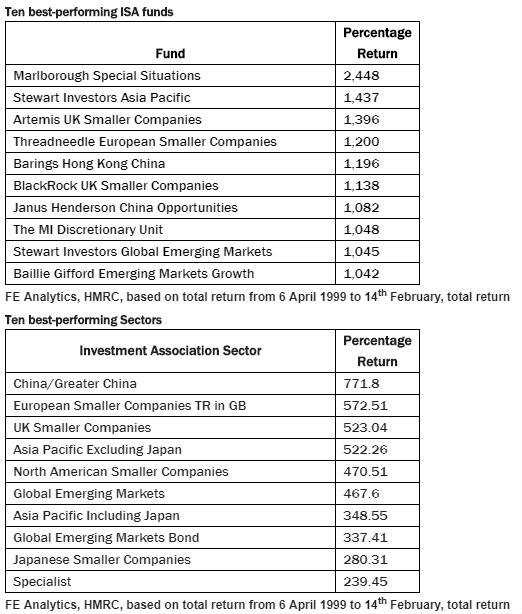

Willis Owen analysis also shows that the best-performing ISA fund over the last 20 years has been the Marlborough Special Situations Fund, which has delivered a tax-free return of 2,448 per cent. The best-performing sector is China/Greater China, which has delivered a return of 771.8 per cent over the past two decades.

Adrian Lowcock, head of personal investing, Willis Owen, said: “The best-performing funds and sectors over the past 20 years provide some interesting insights for investors. The fact China leads the best performing sector and is well represented in the list of top 10 funds reflects the impressive growth of the country as well as emerging markets and Asia over the past 20 years.

“However, the existence of several UK smaller company funds in the list isn’t a surprise to us, we have often believed there have been some exceptional fund managers investing in UK smaller companies and plenty of opportunity for them to outperform.

“Perhaps what is more surprising is that the US didn’t feature higher up in the lists. Over the past decade or more the US has been a difficult market for active fund managers to outperform as it has been very open and efficient making it hard for them to get a competitive edge.”

Adrian Lowcock added: “The success of the ISA has been due to a combination of factors. It has been a fairly simple product to understand, it appeals to both savers and investors alike and it is very flexible, giving people access to their money whenever they need it.”

Mr Lowcock believes the UK, Japan and emerging markets are three attractive themes for investors to consider in the current ISA season because they are currently cheap and have the potential to deliver strong performance going forwards. Funds that he would recommend as investments in these themes include the Merian UK Mid Cap, Man GLG Japan Core Alpha and Lazard Emerging Markets funds.