Household savings fall 74% year-on-year as real returns plummet to their lowest level since 1976

Kevin Brown

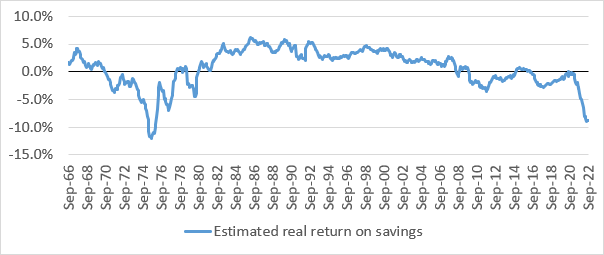

Real savings’ returns have plummeted to their lowest level since February 1976 due to the effects of rising inflation, new figures reveal.

The study by Scottish Friendly and the Centre for Economics and Business Research (CEBR) reveals the real annual return on savings fell to -9.0% in July – the lowest level since February 1976 (-9.5%).

A slight increase in interest rates meant smaller annual falls in August and September, but these still amounted to real term drops of -8.8% and -8.9% respectively (see figure 1).

Figure 1: Estimated real annual return on instant access deposits, 1966 - 2022

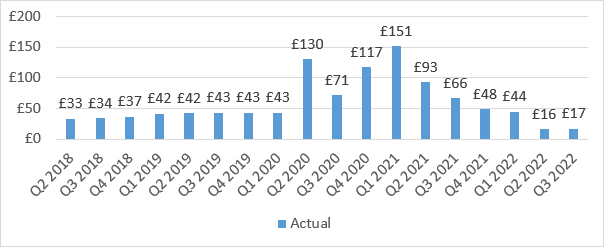

On average households are forecast to have saved just £17 a week in Q3 2022, as inflation remained high (see figure 2). This represents an annual fall of 74.1% with the average household estimated to have saved £66 per week in the same period last year.

To save at the same rate as Q3 2021, households would have had to earn £59 more per week pre-tax or alternatively, spend £49 less in Q3 2022.

Figure 2: Estimate of weekly savings for average UK household, Q2 2018 – Q3 2023

Further analysis shows the true long-term impact inflation has on the real value of savings. A deposit of £100 in 1964 would be worth £2,260 in nominal terms at the end of Q3 2022, which equates to growth of over 2,200%.

However, with inflation accounted for, the real return during this period would fall to just 39.2%, equating to a total of only £139.20 in 1964 prices.

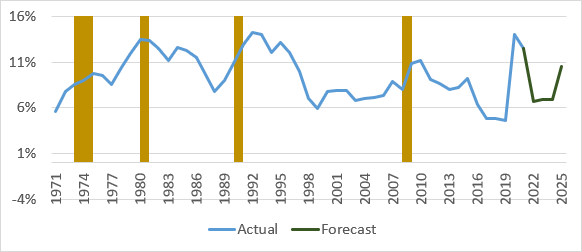

Although real returns remain low, saving levels are expected to gradually improve following the announcement of the Energy Price Guarantee.

Prior to this, it was forecast that the UK savings ratio – the amount of money that households have available to save as a percentage of their gross disposable income – would fall sharply over the next 12 months to a low of 1.9% in 2023.

However, due to changes announced to Government policy, notably via intervention on energy prices, the savings ratio is now predicted to increase to 6.9% in 2023, as a portion of household’s foregone expenditure on energy bills is expected to be saved (see figure 3).

Figure 3: Household savings ratio, actual and forecast, 1971 - 2025

Kevin Brown, savings specialist at Scottish Friendly, commented: “The combined effect of rising inflation, stagnant wage growth and low interest rates means savers have been incredibly hard pressed over the past year.

“These conditions created a perfect storm for savers that resulted in real returns falling to a 46-year low and the UK savings ratio plummeting.

“Although the situation remains dire, the outlook is a little brighter after the government took action to help people cope with rising energy bills, which is set to limit the previously forecasted peak of inflation.

“As interest rates continue to rise, households should be encouraged to save, but it is important to think about how best to protect their money from the eroding effects of inflation while it remains elevated.

“Saving in cash is important in case of emergency or to help meet rising energy bills, but in the current climate, our money has to work harder to keep up with rising living costs.

“Plus, savings providers can be slow to pass on interest rate rises to customers. With that in mind, possibly the best way to make your savings work harder over the longer term could be through the growth potential of an investment ISA.”