Henderson Loggie expands corporate finance team with three senior hires

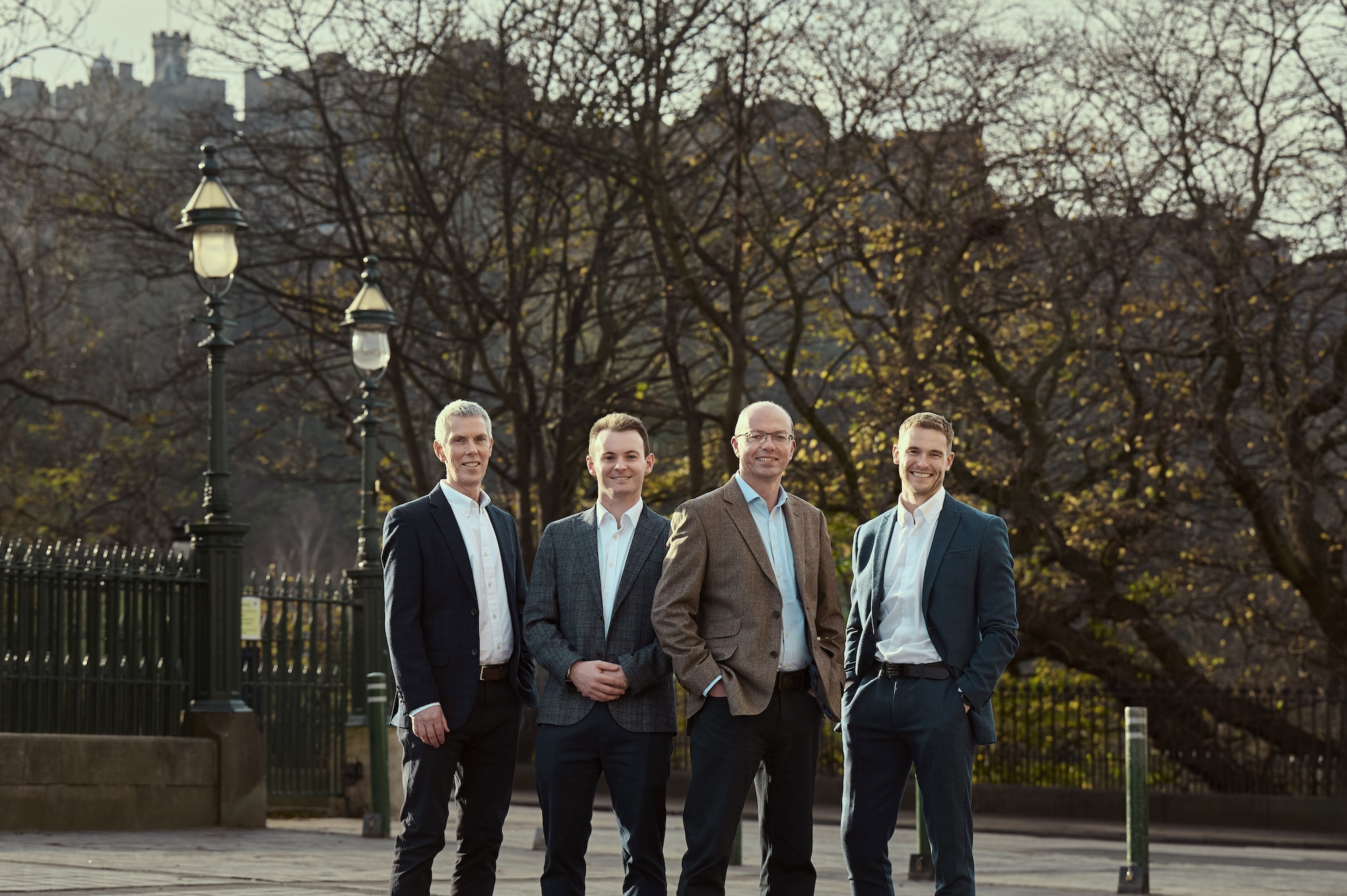

Pictured (L-R): Rod Mathers, Gregor Miller, David Cayzer, and Conor Adamson

Henderson Loggie has expanded its corporate finance team with the appointments of David Cayzer, who becomes corporate finance director, and Conor Adamson and Gregor Miller, who both join as corporate finance managers.

Mr Cayzer joins from UK challenger bank Shawbrook where he headed up the corporate lending division in Scotland. He brings decades of experience in deal structuring, refinancing, management buy outs and acquisitions.

Mr Adamson joins from mid-market restructuring at PwC where he held the position of deals senior associate, and latterly was seconded to Scottish Enterprise equity transactions division where he led and supported investments across sectors including renewables, GenAI, and life sciences.

Mr Miller has multi-sector corporate finance experience covering renewables, whisky, consumer, chemicals and IT sectors, amongst others. He previously worked with a Big Four firm EY and latterly boutique corporate finance advisory practice HNH Partners.

“Our goal is to be the go-to corporate finance adviser to Scottish businesses,” said Rod Mathers, corporate finance partner at Henderson Loggie.

He continued: “The expansion of our team is driven by an increase in deal activity and the prospect of continued growth stimulated by active private equity investors and corporate buyers combined with further changes to capital gains tax rates in 2025 and 2026.

“As part of an independent advisory firm, we have the flexibility to make our own decisions and support clients on terms that work best for both sides thus allowing us to provide real value-added services. Being owner-managers ourselves, we understand the values and challenges our clients face firsthand.

“This alignment lets us focus on what matters most which is delivering a standout experience for each client.”