‘Disastrous’ alcohol duty increase brings £132m tax shortfall

One year after the 10.1% hike in alcohol duty, gin and whisky makers say the boom industry has been stifled.

The August 2023 hike, the largest in almost 50 years, saw prices rise significantly. ONS data reveals the average price of red wine increased by 8%, gin by 6%, and fortified wine by 17%, according to ONS data.

The industry, already struggling with the impact of Covid and rising business costs, claims the duty increase has resulted in a £132 million loss in tax revenue. 70% of UK distilleries fear for their future investment capabilities, The Scotsman reports.

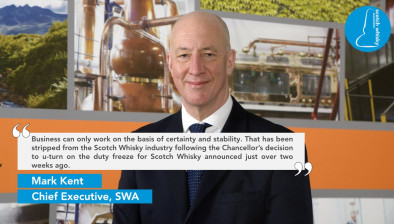

Scotch Whisky Association chief executive Mark Kent, said: “A year on and it’s clear the 10.1% hike in excise duty on Scotch Whisky has been a disaster. It’s hurt business and penalised consumers.

“Most crucially for Rachel Reeves, duty revenue to the Treasury is down £132m – money that could and should have been available to support public services. The Chancellor has the opportunity to get back on track in the Budget on October 30.

“She should reduce the tax burden and, in doing so, reverse the impact of the biggest tax increase on spirits in 40 years, generate more revenue for the public finances, and back growth. She should back Scotland and back Scotch producers to the hilt, as the Prime Minister has promised to do.”