RBS: Scottish private sector remains in downturn in January

Judith Cruickshank

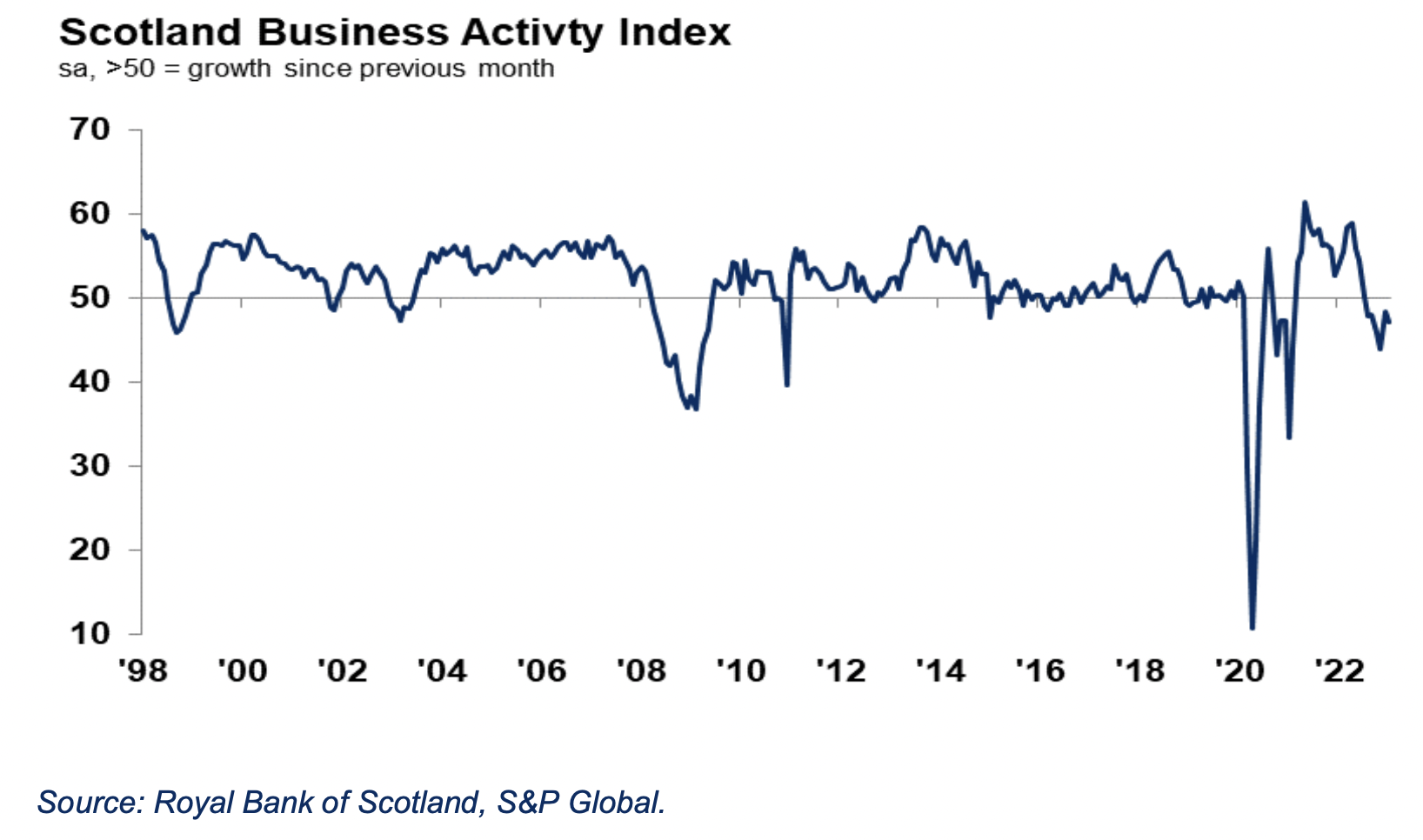

The Scottish private sector reported a further fall in total activity during January according to the latest Royal Bank of Scotland PMI data.

The Business Activity Index - a measure of combined manufacturing and service sector output - fell from December’s five-month high of 48.3 to 47.1, signalling a quickened contraction in private sector output, and extended the current run of contraction to six consecutive months. The rising cost of living, supply chain disruptions and a slowdown in the housing market all contributed towards the latest downturn in activity.

At the sector level, January data revealed that service firms led the decline, registering faster rates of reduction in both business activity and new orders compared to their manufacturing counterparts.

New business received across the Scottish private sector posted a further contraction in January. Moreover, the pace of decrease quickened from December’s three month low, signalling a sharp reduction in new work. The downturn was led by a faster fall in new business received at service providers, while goods producers reported the softest decline in eight months. A slow housing market, transport strikes and squeezed disposable incomes were all in part blamed for the drop in new orders.

Of the 12 monitored UK regions, Scotland registered the sharpest pace of contraction in incoming new business.

After weakening for the second month running, business expectations across Scotland improved during January and printed a six-month high. Optimism largely stemmed from anticipation of new projects and increased activity. That said, the latest reading continued to post below the survey average as worries over the war in Ukraine, energy crisis, slowdown in the real estate sector and the cost-of-living crisis weighed on growth expectations.

Additionally, business sentiment across Scotland registered the third-weakest in the UK, ahead of Northern Ireland and the North East of England.

For the second month running, workforce numbers contracted across the Scottish private sector in January. The rate of job shedding was modest overall and only fractionally quicker than that seen in December. Where a drop in employment was noted, firms cited resignations, redundancies and retirements.

The drop in workforce numbers across Scotland contrasted with the no change seen at the UK-level.

The levels of unfinished work fell during January across Scotland’s private sector, thereby extending the current trend seen since last June. Moreover, the respective seasonally adjusted index ticked down from December’s four month high, signalling the fastest rate of depletion in the aforementioned sequence. According to anecdotal evidence, lower orders allowed firms to work through previous contracts.

The rate of backlog depletion across Scotland was the fastest of all the 12 monitored UK regions.

Firms across Scotland’s private sector recorded a sharp rise in prices during January, thereby stretching the current run of inflation to 32 months. While the rate of incline measured the softest since May 2021, the latest upturn was still marked and historically elevated. According to anecdotal evidence, the incline in input costs was linked to higher prices for raw material, energy and transport, inflation and higher wages.

The pace of input price inflation across Scotland was the second-softest among the UK regions, behind the North West of England.

Private sector firms across Scotland raised their charges for goods and services for the twenty-seventh month running in January. Though the pace of charge inflation slowed to a three-month low, it remained stronger in context of survey data. The rise in charges reflected increasing cost pressures.

Adjusted for seasonality, the Prices Charged Index for Scotland posted below the UK-wide figure.

Judith Cruickshank, chair of RBS’ Scotland board, said: “The start of the year revealed that the downturn in Scottish private sector activity that began last August was extended into 2023.

“Moreover, the latest decline in private sector activity accelerated. It seems unlikely that the sector will bounce back anytime soon as services firms were severely impacted by the depressed demand conditions and the current economic climate.

“The step back in client activity has also resulted in firms trimming their workforce numbers for the second month running. Alongside an ongoing drop in the level of unfinished work, a further reduction in payroll numbers can be expected.

“However, the latest figures indicate that perhaps the worst of inflation has passed. Nonetheless, the current rates of input price and output charge inflation are still elevated and can be detrimental to the health of the Scottish private sector.”