Capital Credit Union’s loanbook and membership intake hits new record

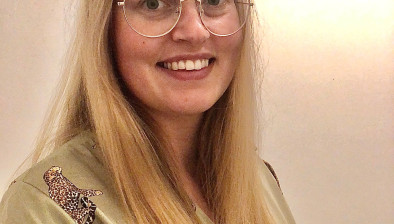

Samantha Homer – Interim CEO of Capital Credit Union

Capital Credit Union (CCU) has recorded its highest-ever monthly intake of new members in its 35-year history, thanks to formal partnerships with Scotland’s sporting community and the greener energy supply chain.

The Edinburgh-headquartered ethical lender attracted 522 new members in February and attributes this success to a new partnership with Scottish Golf, as well as recent deals with some of Scotland’s leading football clubs.

CCU’s link with Scottish Golf has seen 37 clubs around the country sign up to help their members pay their annual subscriptions. In total the credit union has issued over 300 golf loans amounting to over a quarter of a million pounds.

CCU’s interim chief executive, Samantha Homer, said: “This partnership with Scottish Golf has resulted in a big influx of new members and, together with our links in the football community, enables supporters to pay for their season tickets in monthly instalments.

“By providing fair and affordable finance, we’re ensuring that more people can participate in the sports they love without financial strain.”

CCU already has formal partnerships signed up this season with Premiership sides Hibernian, St Johnstone, St Mirren and Ross County, as well as Championship side Dunfermline.

Ms Homer added: “Our membership is expanding at a record pace, with over 4,500 new members joining in the past 12 months. The rising demand for fair and ethical finance continues to drive this strong growth.”

This demand has seen CCU’s overall loan book hit the £30 million mark for the first time with the organisation’s Green Loan accounting for over £2m of that record figure. This enables members to make energy-efficient home improvements or to purchase electric vehicles.

Supporting those with limited financial choices is also central to CCU’s mission, with nearly 2,000 financially excluded members – another record number – accessing loans. Lending to this group is set to exceed £1m for the first time, providing crucial support to those most at risk of financial hardship. This protects members and helps them avoid payday lenders and high-cost debt traps, expanding access to fair credit.