Big Issue Invest powers up Scottish social ventures with £600k of investment

A celebratory event was held in Edinburgh to mark a £600,000 investment and business support into 12 Scottish social ventures by Big Issue Invest.

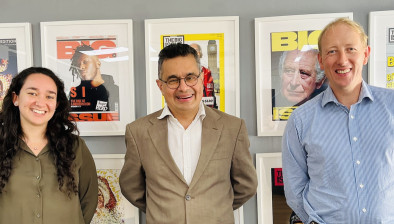

Danyal Sattar, CEO of Big Issue Invest, Dave Gorman, director of social responsibility and sustainability at The University of Edinburgh, Zakia Moulaoui, founder, Invisible Cities and Sandy Macdonald, head of corporate sustainability at Standard Life Aberdeen

Big Issue Invest’s Power Up, a lending scheme offering investment and support to early-stage social ventures across Scotland, was first launched in November 2017 and has supported 18 social business to date with a total of close to 1 million (£950,000) of investment.

The programme is funded by partners, Aberdeen Standard Investments, University of Edinburgh, Experian, Places for People and the Scottish Government with legal support from Brodies LLP.

Invisible Cities were one of 12 social ventures that successfully completed the three month Power Up Programme in 2019. The Scottish social enterprise trains local people who have experienced homelessness to become walking tour guides of their own cities.

Until the investment from Big Issue Invest, Invisible Cities was 100% volunteer lead. Now they have a team of 4 staff – 2 full time and 2 part time. They have a total of 12 guides across Edinburgh, Glasgow, Dundee and Manchester and have recruited York and Cardiff as two franchise cities.

Social enterprises that were supported in 2020 included Blank Faces, a fashion brand tackling homelessness, Social Stories Club, who create socially-conscious gift hampers that have a positive social impact and Eat Sleep Ride, a social enterprise offering therapy of horse riding to develop self-esteem, communication and social skills in those who need help.

Karis Gill, director at Social Stories Club, said: “Power Up has been amazing for us, as it has pushed us to the next stage. We’ve been paired up with mentors and had the most phenomenal expertise and insight into the corporate market. For a small business, this has been truly invaluable.”

Danyal Sattar, CEO of Big Issue Invest, commented: “It has been a fantastic day. We are so pleased, working in partnership with Aberdeen Standard Investments, University of Edinburgh, Experian, Places For People and the Scottish Government and Brodies LLP, to be able to have been inspired by and to have supported these 12 organisations with the investment and business development expertise that they need in order to make an even greater difference within their communities.

“This unique partnership has brought creativity, technical skills and mentoring to early stage social ventures, which adds value beyond the funding they receive.”

Craig MacDonald, head of credit at Aberdeen Standard Investments, said: “It’s great to see the significant impact the Power Up Programme continues to have on a number of early stage social ventures across Scotland. We are delighted to be one of the partners of this very worthwhile initiative. Providing mentoring and advice services can make a very real difference to organisations in their infancy and along with the other partners, we hope to provide valuable guidance and insight.

“Supporting social ventures and working with local communities is a key aspect of the overall sustainability programme at ASI and we look forward to seeing Power Up continue to go from strength to strength.”

Dave Gorman, director of social responsibility and sustainability at the University of Edinburgh, added: “The University of Edinburgh is delighted to continue working with Big Issue Invest as a major partner to Power Up Scotland. The Programme has supported some truly innovative and impactful social ventures which our own students, staff and local communities have enjoyed learning about and using. We look forward to seeing what other ventures benefit from the programme’s support in the following year.”

The Power Up programme is open to organisations across Scotland. The funding available is to enable organisations to build on the good work they currently do within their communities. Whether it’s buying equipment, hiring new talent, or progressing with business development plans. Successful applicants will also receive mentoring and business development support to social ventures for the two-year period.

The programme has been designed for early-stage social ventures, regardless of company structure - social enterprises, charities, and private enterprises are all welcome, with social value creation being the key criterion. The expectation is that many applicants will be accessing finance for the first time.