Big Issue Invest launches Fund IV to boost social impact

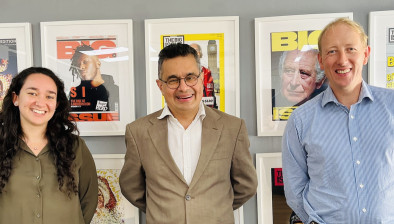

Pictured (L-R): Fund IV's investment team – investment associate Rebecca Moss, CEO Danyal Sattar, and investment director James Potter

Big Issue Invest (BII), the investment arm of the Big Issue Group, is calling for applications to its newly launched Social Impact Debt Fund IV.

Fund IV is a private debt fund, which will lend to organisations across the UK looking to grow their social impact.

The fund will focus on three core sectors – health and social care, affordable housing and social infrastructure (for example co-working spaces, education & training, nurseries and arts organisations). The fund seeks national exposure with an emphasis on areas of poverty and deprivation within the three core sectors.

Poverty and poor health create a vicious cycle, with 1.6 million people in England aged 65 years and over with unmet care needs. Fund IV intends to partner with health enterprises that can provide innovative solutions to improve health outcomes and break this cycle.

Affordable housing is another critical area of focus for Fund IV, as there are currently 274,000 homeless individuals in UK, including 126,000 children.

Currently, there are also over 1.2 million households on social housing waiting lists. Housing costs play a significant role in perpetuating poverty, with 46% of social renters experiencing the highest rate of poverty. Fund IV aims to support organisations that can provide affordable housing solutions and help alleviate homelessness.

The fund also recognises the importance of social infrastructure in addressing poverty and inequality. Communities suffering from high deprivation often lack public spaces, cultural engagement opportunities, and active populations. Fund IV seeks to lend to organisations that improve social infrastructure, such as community centres, shared workspaces, arts performance venues, nursery provision and educational institutes.

The fund provides loans in the £1m - £4m range, typically backed by property assets and where BII will be the sole lender. The loans will be fixed rate and repayable over 3 to 5 years. Borrowers will be established, socially impactful organisations, with a history of profitable revenue generation.

Danyal Sattar, CEO of Big Issue Invest, said: “Big Issue Invest’s Fund IV will truly empower social enterprises to create and deliver solutions to effectively tackle poverty across the UK.

“We are committed to delivering against BII’s mission to fund solutions to meet the UN’s Sustainable Development Goals. This is real impact, from real assets, backed by our outstanding in-house impact team.”

John Gilligan, investment committee member of Fund IV and director of Big Issue Invest Fund Management, said: “Everything we do at Big Issue Invest is focused on supporting people facing poverty.

“Our new Fund stands on the shoulders of the work we have done with our Big Issue vendor community over the last 32 years.”

BII has invested over £80m in deep social impact since 2003 to improve the lives of millions of people.

Previous BII investments that align with Fund IV’s investment strategy include Homes for Good Investments, a provider of quality rental accommodation to those without access to quality housing provision. BII first invested in Homes for Good in 2020.

Susan Aktemel, CEO of Homes for Good Investments, said: “BII has enabled us to be more entrepreneurial in our property development programme, ensuring profitability and social impact for the long term.”