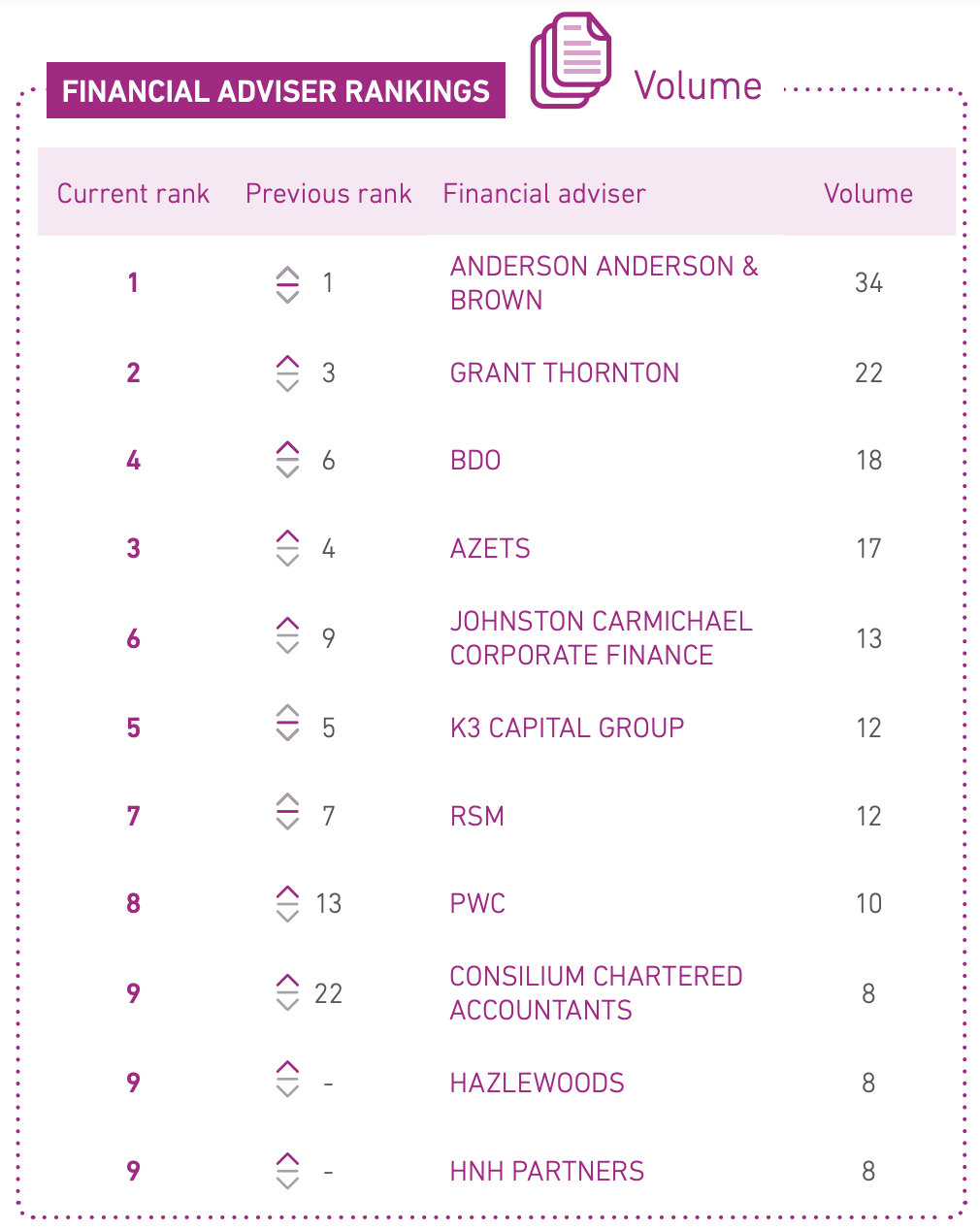

AAB tops Experian table with 34 deals

AAB has again retained its top spot in Scotland’s financial adviser rankings with 34 deals, the latest Experian M&A report has revealed.

The M&A Review (FY 2024) details that there were several notable deals announced in the final months of the year. HM Treasury continued to reduce its stake in NatWest, with an off-market purchase by the banking group lowering the UK government’s percentage of voting rights from 14.2% to 11.4%. Since December 2023, the government has decreased its stake in NatWest from 38%. Should the offer proceed, Edinburgh-based waste management company Renewi will become the latest London-listed company to exit the stock exchange.

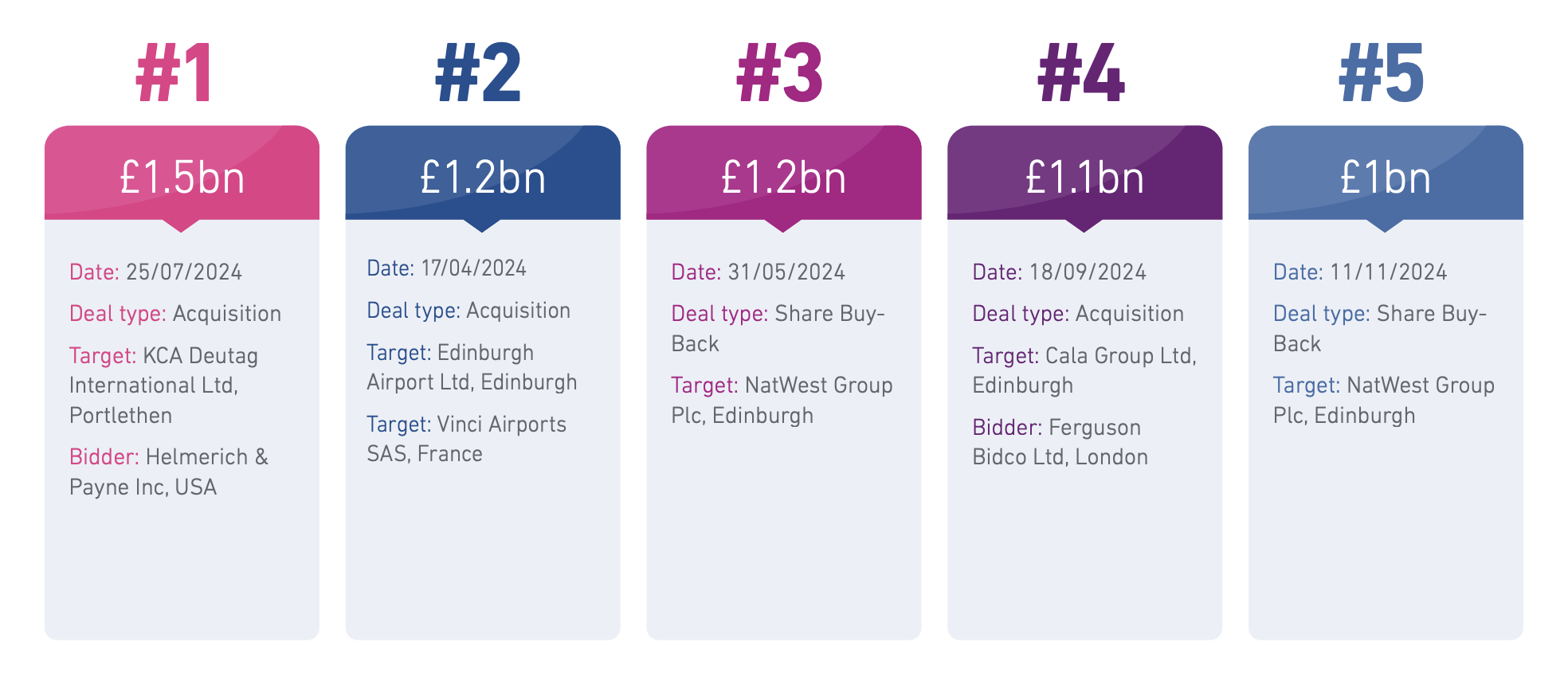

Top deals in 2024 (source: Experian M&A Review)

US acquirers were the most active overseas investors in Scotland, with the highest value deal being the July acquisition of Aberdeen-headquartered KCA Deutag International by Helmerich & Payne of the USA for £1.5 billion. This transaction positions the company as a leading rig provider in the Middle East market. These transactions reflect the dynamic and diverse nature of M&A activity in Scotland, with the volume of activity reflecting growing confidence amongst the region’s dealmakers.

Grant Thornton took second place in the latest rankings, up from third, followed by BDO and Azets. Johnston Carmichael moved up to sixth from ninth, while K3 Capital remained in fifth position.

Financial adviser rankings (source: Experian M&A Review)