AAB holds top spot in Experian M&A rankings for second year

AAB has again has retained its position as top financial adviser in Scotland with 20 deals, according to the latest Experian M&A rankings.

The M&A Review (YTD 2024) records that Scotland’s M&A market is one of the few to have bucked the national trend of “volume down, value up”, as the region continues to enjoy a sustained period of stability.

Transactional patterns held steady, with the 313 deals recorded in the year to date only marginally lower than the 316 in the same period last year.

The reporting lag means that this figure is likely to move into growth territory on revision at year end. Meanwhile deal value was up by 18.7%, from £5.3 billion in 2023 to £6.3bn so far this year, with momentum growing quarter on quarter throughout the year.

In the latest rankings, Grant Thornton and Azets both moved up one position to second place with 15 deals and third place with 11 deals respectively. They were followed by RSM, which moved up from sixth position. BDO placed fifth, up from eighth, taking the spot from K3 Capital, which is has moved down to sixth position.

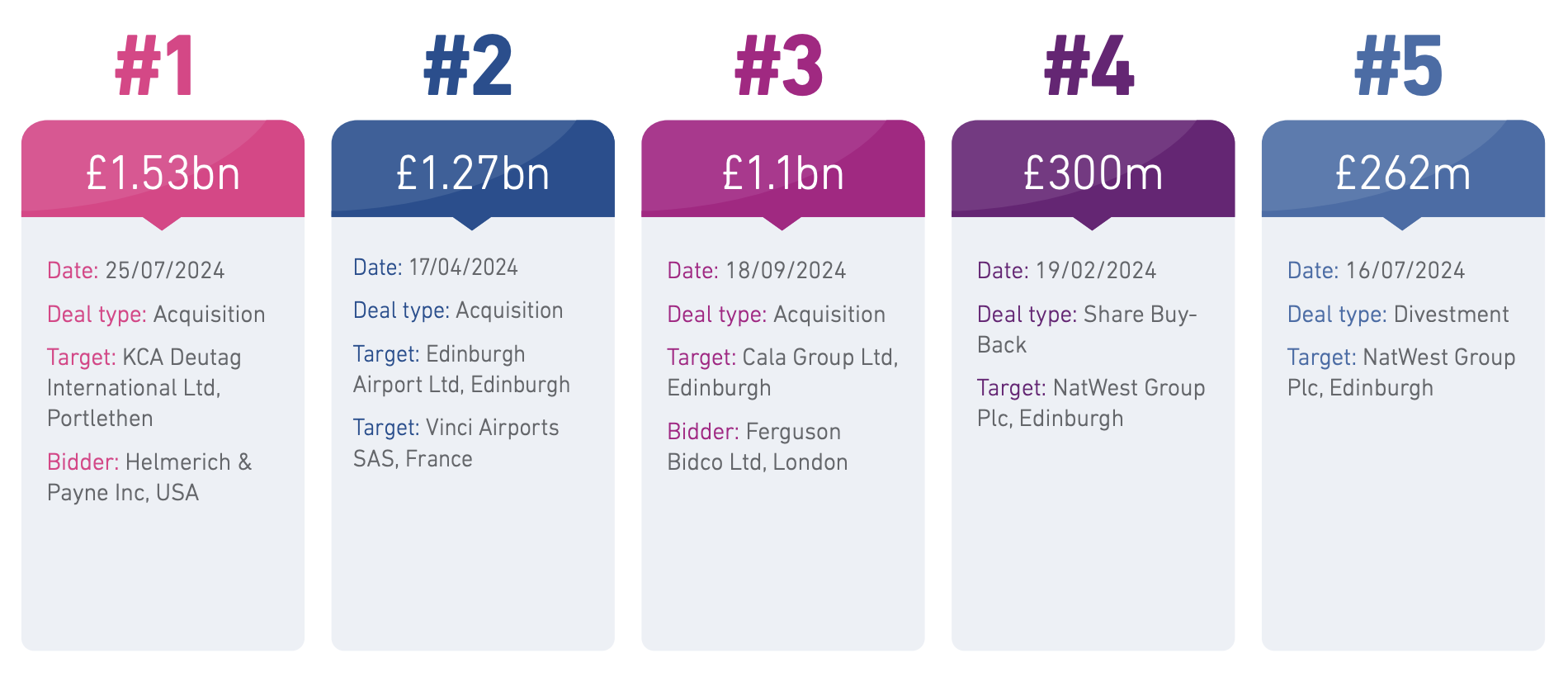

Overseas investors have continued to be active acquirers of Scottish businesses throughout the year. Notable deals in Q3 include the acquisition of Aberdeen-headquartered KCA Deutag International by Helmerich & Payne of the USA for £1.5bn, positioning the company as a leading rig provider in the Middle East market.

Top five M&A Scotland deals in 2024 YTD

In the construction sector, Edinburgh-based housebuilder Cala Group agreed to be acquired by a private equity consortium of Sixth Street Partners and Patron Capital for an enterprise value of £1.35bn. This deal places Cala in a strong position to advance its strategic plans. Additionally, US private equity firm One Equity Partners acquired EthosEnergy for £140m. EthosEnergy provides MRO services, as well as maintenance for industrial gas turbines, and the acquisition is expected to support its growth amid increasing global demand for electricity.

On the domestic front, the UK government continued to reduce its stake in NatWest, selling another tranche of shares for £262m and bringing its ownership to just under 20%. These deals continue to highlight the growth potential of Scottish businesses and underscore the interest and confidence international investors have in the region.