AAB tops Experian M&A league

AAB has kept its top financial adviser ranking with 18 mergers and acquisition deals completed during 2023, according to Experian’s latest United Kingdom and Republic of Ireland M&A Review.

This is despite Scotland’s M&A market having witnessed a slowdown in the last year, marking a departure from consecutive years of growth.

Total figures fell by 15% compared to 2022, with 394 transactions announced throughout the year, amounting to £7.3 billion. Quarterly results displayed a consistent decline from 108 deals in Q1 to 90 deals in Q4.

In second place is newcomer Cortus Advisory, which has jumped up from 17th position after having completed 16 deals. Grant Thornton has moved down to third position with 14 deals closed.

With 13 deals, Azets has moved down one position to shared fourth with K3 Capital Group, which has jumped up from 14th. BDO and RSM have come in at sixth and seventh, respectively, with ten deals each. They are followed by HNH Partners in eighth, up from 18th, Johnston Carmichael, which has moved five ranks down to ninth, and Altius Group in tenth.

In terms of deal segments, small cap deals dropped by 22%, large deals by 46%, and mega deals reduced to only three, down from eight in 2022. However, mid-market deals experienced a 17% decline in volume, while the total value of £818 million remained relatively consistent.

Acquisitions remained the most popular deal type, constituting 66% of total deal volume, worth £1.4bn. Employee buy-outs witnessed an 80% year-on-year increase, emerging as a potential exit route for company owners.

Scottish deals represented 6% of the UK’s total M&A activity by volume and contributed 4% by value in 2023.

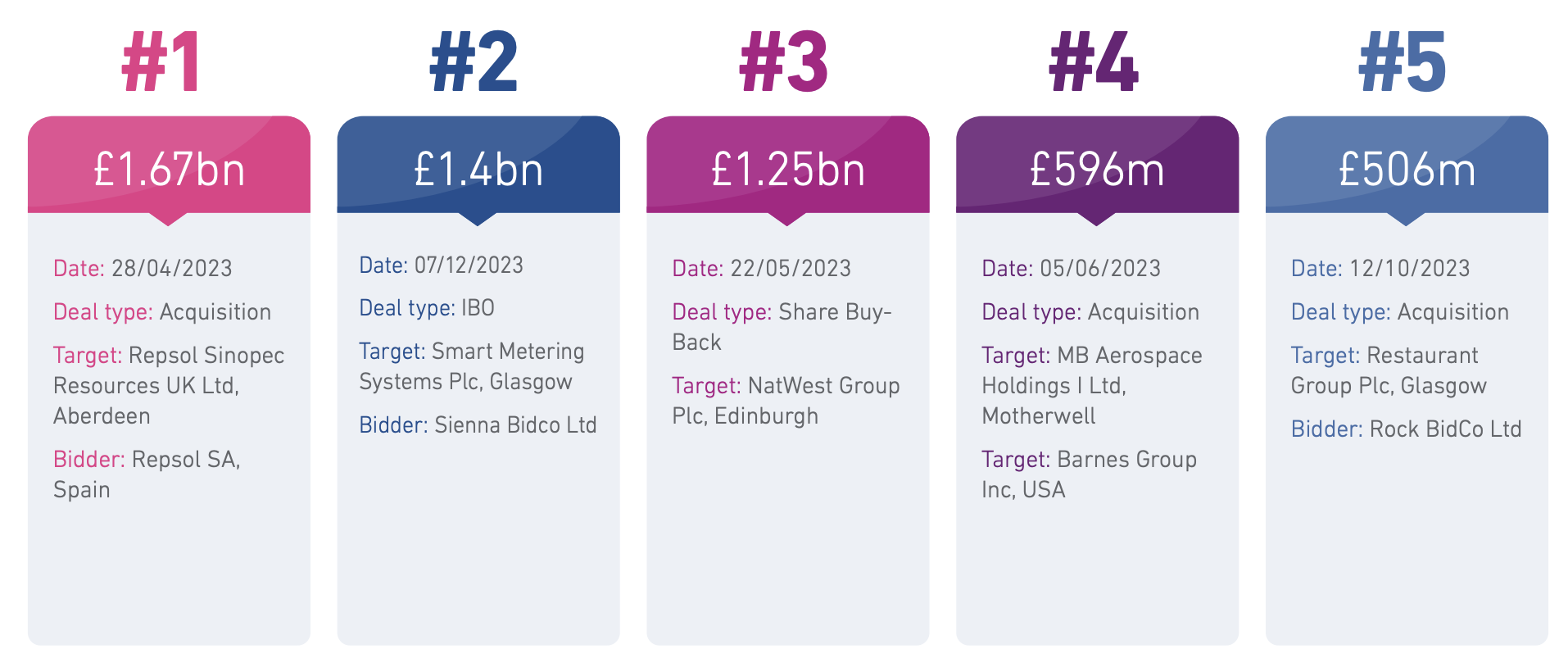

The largest transaction in Scotland in 2023 was Repsol’s £1.7bn cash acquisition of the remaining 49% stake in Repsol Sinopec Resources UK. The second-largest deal was the £1.4bn investor buy-out of Smart Metering Systems by US private equity house Kohlberg Kravis Roberts.

Top five Scottish M&A transactions by value in 2023 (source)

Other notable transactions included NatWest’s £1.3bn off-market purchase of shares from HM Government and Barnes’ acquisition of MB Aerospace for around £600m.

The professional services sector emerged as the most active in Scotland, representing 33% of all transactions with 130 deals, up by 17% year-on-year. Manufacturing, which was the busiest industry in 2022, saw a decline in both volume and value. Agriculture, forestry, and fishing were the only sectors to experience growth, with activity doubling since 2022.

The increased cost of borrowing impacted Scotland’s M&A landscape, leading to a 43% decline in debt-funded deals by volume and an 88% drop in value. However, debt funding continued with ThinCats emerging as the top funder. Private equity and venture capital-backed deals remained relatively stable, with 86 transactions worth £1.7bn. Scottish Enterprise led the investment landscape with 18 deals, outpacing other investors like the Business Growth Fund, which closed eight deals.