AAB makes key shifts in tax team

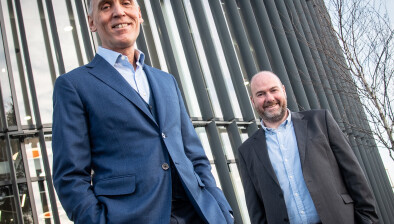

Alistair Duncan, Malachy McLernon, and Neil Dinnes

Tech-enabled business critical services group, AAB, has made key shifts in its leadership team following a period of strong growth.

The reshuffle sees Malachy McLernon, corporate tax partner, appointed as head of corporate and indirect tax, succeeding Neil Dinnes who transitions into the newly minted role of group business development partner. Concurrently, Alistair Duncan has earned a promotion to indirect tax partner.

Since becoming part of the AAB team when Ireland-based accountancy and business consultancy firm FPM joined AAB Group in May 2022, Mr McLernon has worked closely with colleagues across all of AAB’s locations to support a wide range of clients from owner-managed businesses to large multi-nationals.

Mr McLernon said: “As part of AAB Group, we are on a truly exciting journey with ambitious expansion plans. The period of growth we’ve experienced would not have been possible without our fantastic team collaborating with great clients.

“I’m looking forward to empowering even more collaboration across the Group, and helping our teams to continue providing the outstanding service our clients know and love.”

Mr Dinnes, the former head of corporate and indirect tax will continue to drive new business growth across the UK and internationally in the newly created role of group business development partner whilst allowing him to retain and build his client portfolio going forward.

He commented: “The group is growing at an outstanding rate, and as a result the opportunities for business development have never been greater. I am looking forward to supporting exceptional growth across our services lines and to sharing these opportunities with our clients.”

Mr Duncan, who has been promoted to indirect tax partner, joined AAB’s indirect tax team in 2016. He has guided businesses across all industries by supporting clients to manage the complexities around VAT, customs duty and other indirect taxes.

Commenting on his promotion, Mr Duncan said: “We have an outstanding VAT & Customs Duty team at AAB working across the UK and Ireland supporting clients internationally in an area of tax that is becoming more and more complex. I am looking forward to playing my part in delivering our ambitious growth plans in the years ahead.”