People saving for a home among most at risk of financial catastrophe if they become ill or injured, ABI data reveals

Young people saving for a home are most at risk of suffering the largest financial loss if they were unable to work due to illness or injury, the Association of British Insurers (ABI) has revealed.

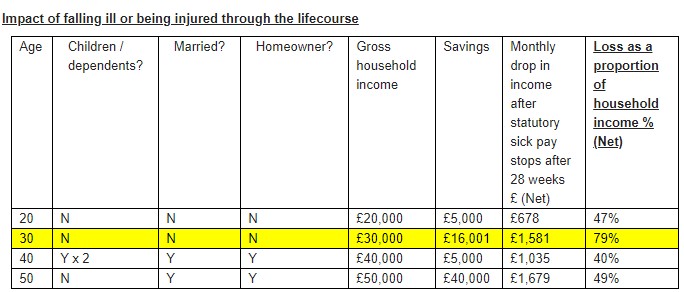

The ABI’s analysis, using its income shock calculator ‘Percy’, found that someone with more than £16,000 saved up for a house deposit, who has no dependants and has not protected their income with insurance, stands to lose as much as 80% of their monthly take-home income. This is because anyone with more than £16,000 in savings is not entitled to support from Universal Credit (UC) when ill or injured, despite this being significantly lower than the UK’s average house deposit of £41,099.

For someone earning £30,000, this is equal to a drop of more than £1,500 every single month, from £1,995 to just £389.

Further analysis shows that even those with children, or no savings at all, stand to lose around half their monthly take-home pay if their income isn’t protected against sudden shocks, raising concerns about the affordability of rent, mortgage payments and other general living costs.

The figures highlight the difficulty that people could face if their income isn’t protected. Losing up to 80% of net pay would mean having to immediately rely on the cash they’d saved to buy their first home, potentially jeopardising their dreams of homeownership, because they do not qualify for UC.

The chart above shows the journey one person could possibly go through as they build their savings, buy a home and start a family. They start off with a lower salary and a small amount of savings, which grows as they reach the age of 30 and now sits just above the £16,000 threshold for receiving any support through Universal Credit when ill or injured.

As the following years go on, the person builds their savings, has two kids with their new partner and eventually uses their savings to buy a home – thus depleting their savings pot but increasing their Universal Credit entitlement. This person’s savings then continue to grow as their kids eventually move out and are no longer considered ‘dependants’, which means their Universal Credit entitlement decreases, but they do own their own home. As demonstrated above, a person with £16,000+ in savings stands to suffer the greatest financial shock of nearly 80%.

The income drop varies so distinctly because the amount of support a person is entitled to is based on a wide range of different factors. One crucial factor is the amount of savings a person has – for instance, if you have more than £16,000 you will not be entitled to any support from Universal Credit at all. Universal Credit is then tapered for savings below £16,000.

This means that for the first 28 weeks of being off work, you would be entitled to statutory sick pay of £408 (unless self-employed), which would then be replaced by national insurance-based allowances for the following year, which is likely to be even less than the statutory level of sick pay. You may be entitled to other benefits, such as council tax support or other allowances, depending on your situation. Fill in the ABI’s tool, Percy, to find out more.

Yvonne Braun, Director of Long-Term Savings and Protection at the ABI, said: “Without the proper protections in place, many people face a financial catastrophe if they unexpectedly fall ill or are injured and are unable to work. This is particularly pronounced for younger people who have saved diligently for a house deposit as any savings above £16K wipe out their entitlement to Universal Credit, leaving them almost entirely reliant on their nest egg.

“Falling seriously ill, or indeed severely injuring yourself, can be incredibly stressful on its own, which is why we want to empower people to take action to ensure that they don’t also have to deal with financial worries at the same time.”