MP slams RBS over leasehold repossession policy which is “kicking people when they’re down”

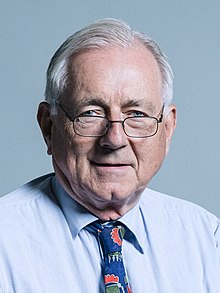

Peter Bottomley

A senior MP has launched a withering attack on Royal Bank of Scotland over its treatment of its mortgage customers who have fallen victim to the leasehold racket and subsequent crisis that has resulted from the ongoing consumer scandal.

Peter Bottomley, chair of the All-Party Parliamentary Group on Leasehold and Commonhold Reform, has accused the still 62 per cent state-owned, bailed-out bank of enforcing aggressive debt collection policies against customers who own leasehold properties but fall into arrears.

Currently, RBS allows leaseholders to repay such debts over a maximum of five years in exceptional circumstances, but its policy remains significantly more stringent than any of its major rivals.

According to Sir Peter, Edinburgh-based RBS’s current policy, in most cases where customers fall into arrears owing to disputes with their freeholder or property management company, is to force them to repay the debt within 12 months or face repossession, despite a longstanding legal precedent that allows most borrowers to repay mortgage arrears over the remaining term of their loan.

The UK’s five other largest banks have said they either capitalised leasehold-related payments on to customers’ loan principal, or allowed them to be repaid over an agreed period like normal arrears.

In a letter to one customer who requested to pay their debts over their mortgage term, RBS said fast repayment was “a reasonable request” because service charges were “a normal commitment” they should have been prepared for, despite acknowledging in the same letter that the debts had “occurred due to circumstances beyond your control”.

But Sir Peter has now called on RBS to reverse the crisis-era policy, and stressed that he will also invite the bank’s bosses to explain their approach to the APPG and government.

Sir Peter said he would also write to RBS in his capacity as a private shareholder ahead of its annual meeting later this month. “If they choose to reverse these [tough] penalties on innocent borrowers they will earn my respect,” he said.

Responding to Sir Peter’s intervention, RBS told the Financial Times: “We continually review our policies and will look again at them in this area to be certain that they ensure fair outcomes for customers.”

Sebastian O’Kelly, chief executive of the Leasehold Knowledge Partnership, a charity that supports leaseholders, described RBS’s policy as “very aggressive”.

“The threat of forfeiture is already a nuclear weapon for freeholders in disputes . . . It’s unfair enough as it is without banks making it worse — it feels like kicking people when they’re down”, he said.