Downgraded forecasts slash RBS share price as bailed-out bank again named UK’s worst

It has been a depressing 24 hours for still 60 per cent state-owned Royal Bank of Scotland after it was again dead last in an official study ranking UK high street banks for customer service, and two key brokers lowered their forecasts for the lender’s prospects, sending its share price tumbling.

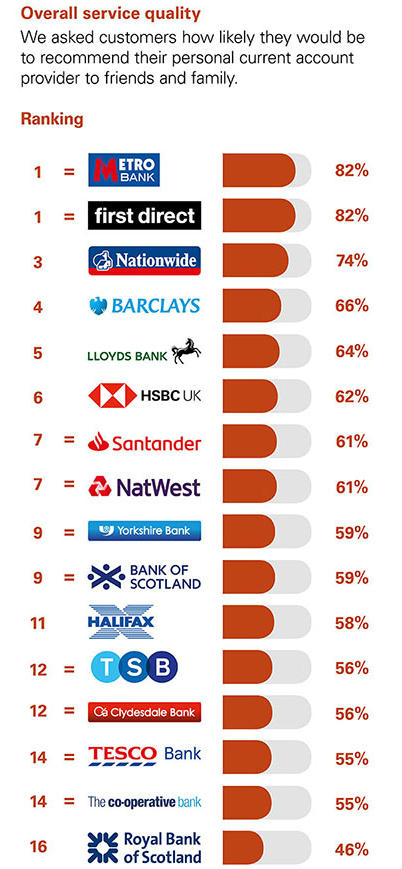

Edinburgh-based RBS said it can do better after the independent survey of 16 banks by Ipsos Mori, which is a regulatory requirement, found that RBS, along with the other Scottish-based companies, were all ranked in the bottom half for customer satisfaction.

And RBS was left propping up the table with dismal rankings for overall service quality and lagging behind the rest for services including current accounts, overdrafts, branches and online and mobile banking.

According to the survey, RBS offers the personal current account customers are least likely to recommend, with just 46 per cent saying they would – a drop from the 49 per cent overall satisfaction rating it had this time last year when it again finished last.

(Ipsos Mori)

RBS’s misey was compounded as its share price was also sent plummeting by more than 10 per cent, or 20.8p to 177.65p yesterday after two key brokers lowered their forecasts.

Macquarie moved the bank’s rating from buy to neutral, slashing its target price heavily.

Goldman Sachs held firm on its buy rating for RBS, but still cut its target price, denting investor sentiment.

Meanwhile, the Ipsos Mori poll of UK banks found Metro Bank and First Direct finished top for overall service quality with 82 per cent saying they’d recommend their accounts.

Clydesdale was equal 12th while the Bank of Scotland was equal ninth.

Jenny Ross, money editor with the consumer organisation Which?, said: “RBS also finished near the bottom of our satisfaction rankings, with customers unimpressed with the bank’s customer service, complaints handling and the transparency of charges. The message that improvements are urgently needed really couldn’t be clearer.

“Our research has shown that bigger is not necessarily better when it comes to choosing a bank – innovation and outstanding customer service from some challenger banks have shaken up the market and placed them well ahead of household names.

“Anyone unhappy with the level of service they are getting from their bank should consider switching providers – it has never been easier and takes just seven days.”

An RBS spokesman said: “We know we can do more to improve the experience for customers in certain aspects of our service. We are investing in dedicated teams focused on making targeted improvements for customers and rolling out continuous changes to make banking easier, such as our software to help reduce queuing times in branches and expanding our AI technology, Cora.”